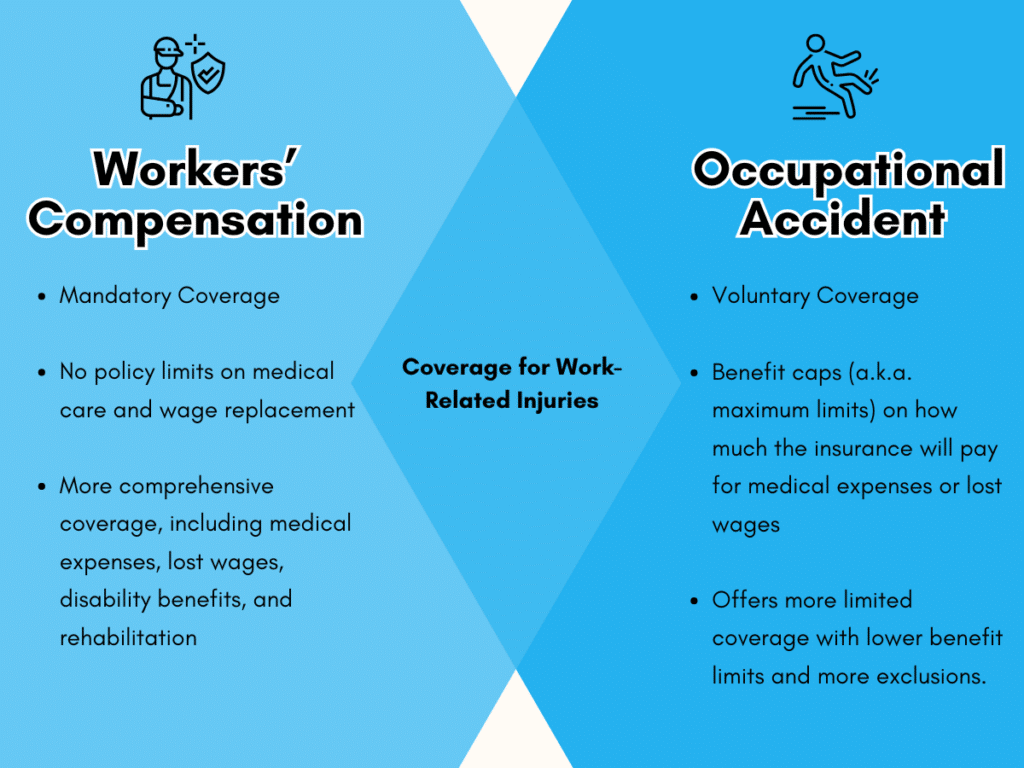

One of the most important concerns for both workers and businesses is the health and safety of their workforce. Workers’ compensation insurance and occupational accident insurance are two important insurance policies. They each come into play when it comes to the protection and safety of the workplace. In spite of the fact that both offer financial aid in the event of a workplace injury, there are substantial differences between them in terms of their structures, coverage, and the conditions under which they are applicable.

Workers Compensation

Companies that employ a minimum number of workers or employees who work a specific number of hours per week as defined by law are required to comply with the workers’ compensation requirement, which is a state-regulated requirement. The minimum number of employees varies from state to state. In some states, it means one or more employees, while in others, it means five or more. For more information on state-specific workers’ compensation requirements, visit the U.S. Department of Labor’s Worker’s Compensation page.

Workers’ compensation provides payments for wage loss, medical treatment and related expenditures, and rehabilitation for employees who sustain an injury on the job or who become ill as a result of elements that are present in their workplace environment. In addition, the insurance policy provides coverage for employer liability, which means that businesses are afforded some degree of protection in the event that an employee decides to file a lawsuit in connection with their workers’ compensation claim. More frequently than not, the costs of legal defense are covered up to the limitations of the policy. It is still the responsibility of employers to ensure that their employees are working in a safe environment.

Occupational Accident Insurance

Occupational accident insurance is a policy that provides benefits to independent contractors and employees who are not protected by a workers’ compensation program. This sort of insurance may give medical, disability, and accidental death and dismemberment benefits. But it is not state-regulated, unlike workers’ compensation. Wage loss benefits, medical expenditures, and rehabilitation costs for workers or insured independent contractors may be paid by policies, but only up to policy limits. Employers can determine their coverage and deductible amounts based on their own risk tolerance.

Workers’ compensation is more expensive for businesses, but it provides more complete coverage, particularly in terms of their own liability, which is not covered by occupational accident insurance. Employers who purchase occupational accident insurance may be exempt from the mandatory workers’ compensation system in several states. While the employer still has a legal commitment to employees who are injured or killed on the job, it is significantly less expensive than workers’ compensation. Employers receive statutory benefits through workers’ compensation, however when purchasing occupational accident insurance, you must make the following decisions:

- The limit of liability to carry per accident.

- The deductible to assume per accident.

- The level of disability coverage to provide.

- The level of death benefits to provide.

Companies will still be liable to their employees for legal responsibilities that are not covered by occupational accident insurance. Choosing the wrong coverage selection might expose a company to significant financial losses – a danger that workers’ compensation insurance protects against.

How They Differ

Workers’ Compensation

- Mandatory Coverage – Workers’ Compensation Insurance is a state-mandated program that mandates employers to provide coverage for employees who are injured or ill at work. The standards and regulations may differ from one state to the next.

- No-Fault System – Workers’ Compensation is a no-fault system, which means that employees are eligible for payments regardless of who caused the job accident. This method is intended to give injured workers prompt compensation without the need for lengthy court battles to identify fault.

- Eligibility – In the US, workers’ comp is generally available to all employees, regardless of fault or negligence. It is mandated by state laws to ensure that employees are protected in case of work-related illnesses or injuries. Whether they’re a full-time employee, part-time worker, or seasonal staff, they’re typically covered under workers’ compensation. That is if your company meets the legal requirements.

- Covered Benefits – Workers’ Compensation often pays for medical bills, rehabilitation costs, and a portion of an injured employee’s salary while they are unable to work. Long-term compensation may be awarded in the case of permanent impairments.

- Employer Immunity – When covered by Workers’ Compensation Insurance, employers are generally protected from lawsuits made by employees for occupational injuries. This exemption is a trade-off designed to expedite the procedure and ensure that injured workers receive early compensation.

- State Regulated – Workers’ Compensation programs are governed by state agencies. Each state has its own set of laws governing coverage criteria, benefits, and claim management.

Occupational Accident Insurance

- Voluntary Coverage – Occupational Accident Insurance is often bought by employers to provide additional protection beyond what Workers’ Compensation may provide.

- Fault Considerations – Occupational Accident Insurance, unlike Workers’ Compensation, usually considers fault when deciding compensation. Coverage may be limited if an employee is deemed to be at fault for their injury.

- Flexible Coverage – Employers can tailor Occupational Accident Insurance coverage to their specific requirements. Medical bills, disability benefits, accidental death benefits, and other benefits may be covered. The scope of coverage, however, is determined by the specific policy chosen.

- Eligibility – Occupational Accident Insurance is designed specifically for workers who are not eligible for workers’ compensation, such as independent contractors and other workers. Due to the fact that they are not typically covered by regular workers’ compensation plans, individuals who are self-employed, freelancers, and gig workers are examples of individuals who can benefit from occupational accident insurance. These non-traditional workers, who may be exposed to a variety of unique dangers and difficulties, are afforded an additional layer of protection by occupational accident insurance.

- Excludes Certain Risks – Certain hazards or activities may be excluded from coverage under occupational accident insurance policies. And employees may be required to meet specified requirements to be eligible for compensation.

- No Employer Immunity – Occupational Accident Insurance, unlike Workers’ Compensation, does not protect companies from employee lawsuits. If an employee has this coverage and suffers a working injury, they maintain the ability to sue their employer.

Choosing The Right Coverage

- Consider Legal Requirements – Employers must comply with state-mandated Workers’ Compensation requirements. Failure to do so can result in legal consequences. While options, many consider Occupational Accident Insurance to be an additional layer of protection.

- Evaluate Risks and Budget – It is important for employers to evaluate the dangers that are associated with their industry as well as the financial repercussions that could result from injuries that occur on the job. It is possible for occupational accident insurance to provide supplemental coverage that is tailored to specific requirements.

- Communicate With Your Employees – Important is the transmission of the available insurance coverage in a clear and concise manner. It is important for employees to be aware of their rights under Workers’ Compensation as well as any additional coverage that may be given by Occupational Accident Insurance.

- Consult With An Insurance Agent – When it comes to navigating the complexity of Workers’ Compensation and Occupational Accident Insurance, it might be helpful for companies to seek counsel from insurance professionals. They have the ability to help select the coverage that is best suitable for the specific conditions of your company.

Wrapping Up

EZ is the place to go if you are seeking workers’ compensation insurance. We take great satisfaction in making your shopping experience as simple and stress-free as possible. Not only do we provide our consumers with our undivided attention, but we also provide entirely tailored service and quick outcomes. Once you have completed our form, you will immediately be provided with free estimates from one of our representatives. A person who will comprehend your requirements from the very beginning. To ensure that you make the greatest choice possible and obtain the best coverage at the best price, we want to make sure that you do so. Make sure you check out your quotes right away because none of our services cost you anything.

For any questions, please do not hesitate to call us at (855) 694-0047. You’ll speak with a local insurance agent that is able to provide answers to all of your questions. In addition, we can assist you in locating the workers’ compensation policy that is most suitable for your company. Or for free instant quotes just enter your zip code into the box below.