Have you ever found yourself debating whether or not to purchase vision insurance? With the cost of routine eye exams, prescription eyeglasses, and contact lenses on the rise, it’s no wonder many people are wondering if vision insurance is worth the investment. In this blog post, we’ll discuss the benefits and help you determine if it’s worth it for you. We’ll also highlight a leading vision insurance provider, VSP Individual Vision Plans, and explain why they are a great option to consider when shopping for plans. Whether you have perfect eyesight or need corrective lenses, keep reading to learn more about the importance of vision insurance and how it can benefit you.

Maintain Healthy Vision

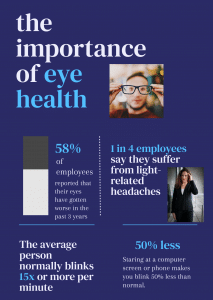

First and foremost, regular eye exams are essential for maintaining healthy vision. While health insurance may cover some vision-related expenses, it typically doesn’t cover the cost of routine eye exams. Vision insurance can help offset the cost of these exams, making it more affordable for you to prioritize your eye health. In addition to routine exams, it can also cover the cost of prescription eyeglasses and contact lenses, as well as frames and lenses upgrades.

Network Of Doctors And Specialists

Another benefit of vision insurance is the access to a network of eye doctors and specialists. You can choose from a network of providers that offer discounted rates on services and products. This means you can see an eye doctor you trust without having to pay full price out of pocket. Plus, many vision insurance plans offer online tools to help you find a provider near you, making it easy to schedule appointments and access care.

VSP Individual Vision Plans

With VSP Individual Vision Plans, you’ll also have access to a network of over 38,000 eye doctors, making it easy to find a provider you trust. Plus, their website offers helpful tools and resources, including a cost calculator to estimate your out-of-pocket expenses and a frame gallery to help you find the perfect pair of glasses.

The Bottom Line

Vision insurance is a great way to guarantee access to care and protect your overall eye health. Investing in a single annual premium might cost more initially, but consider the savings you could collect by not having to pay as much for routine visits down the road. Plus, providers such as VSP Individual Vision Plans can offer exclusive deals that are only available with their plans too. Remember to weigh all of your options before making a decision. Do some research into your different needs and consider if investing in vision insurance makes sense for yourself or your family. Who knows? It might even save your sight someday!