You’re probably already familiar with Original Medicare, especially if you’re nearing the age of 65 and getting ready to enroll. You may not be aware, though, that there are some gaps in Original Medicare’s coverage, which lead many people to either add a Medicare Supplement Plan or choose a Medicare Advantage Plan. Medicare Advantage Plans, also known as Medicare Part C, are very similar to Original Medicare. However, there is a slight difference between the two, mainly that Medicare Advantage Plans offer more coverage than Original Medicare.

Original Medicare Overview

Medicare is a government health insurance program consisting of:

- Part A– Hospital insurance that covers hospital stays, skilled nursing care facilities, hospice care, and limited home healthcare services.

- Part B– Medical insurance that covers preventive services, doctors’ office visits, flu shots, physical therapy, durable medical equipment, diabetes screening and supplies, and mental health care.

In most cases, you will not pay a monthly premium for Medicare Part A; the Medicare taxes that you paid while you were working are what pay for Part A. However, Part A does have a deductible, coinsurance, and co-payments.

Part B, on the other hand, does have a monthly premium: the Medicare Part B premium for 2020 is $144.60, but could be higher depending on your income. Like Part A, Part B also has a deductible, coinsurance, and co-payments for most services. Medicare Part B covers 80% of your costs, meaning you will need to pay the remaining 20% of any bills.

Medicare Advantage Overview

Medicare Advantage is an “all-in-one” alternative to Original Medicare. Private insurance companies approved by Medicare can offer Medicare Advantage Plans. Unlike Original Medicare, most Medicare Advantage Plans include prescription drug coverage, and some plans offer more benefits, like routine dental or hearing care. In order to be eligible for Medicare Advantage, you have to be enrolled in Medicare Part A and Part B. You must also live in the plan’s service area, and you cannot have end-stage renal disease. Medicare Advantage Plan premiums differ from plan to plan. Many Medicare Advantage Plans have low-cost, or even $0, premiums. The average Medicare Advantage premium is only $30 a month. Remember, you will still have to pay your monthly Medicare Part B premiums in addition to any Medicare Advantage premium.

Medicare Advantage Plan premiums differ from plan to plan. Many Medicare Advantage Plans have low-cost, or even $0, premiums. The average Medicare Advantage premium is only $30 a month. Remember, you will still have to pay your monthly Medicare Part B premiums in addition to any Medicare Advantage premium.

The Similarities

All Medicare Advantage Plans have to offer at least the same benefits as Medicare Parts A and B do. This means that if Original Medicare covers hospital care at a certain level, then so will a Medicare Advantage Plan.

The Differences

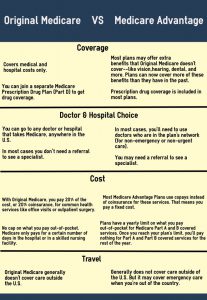

The benefit of Medicare Advantage Plans is that they offer more coverage than Original Medicare. The following chart breaks down the differences between the two: