This past October, the CMS released the new rates for Medicare deductibles and copays for 2019. It is important to review the new rates to determine if it is affordable for you and your situation. If you can not afford the raised rates, then now would be the time to make some budget changes, or consider a Medicare Supplement plan. Most, if not all, Medicare Supplement plans will cover the deductibles and copays.

The New Rates

-

- Medicare Part A Hospital Deductibles have gone up $24 from 2018. It is now $1,364.

-

- Medicare Part A Deductible for a Skilled Nursing Facility for days 20-100 have gone up $3 per day since last year. The cost is now $170.50 per day.

-

- Medicare Part B Deductible has gone up $2 from 2018. It now costs $185.

-

- Medicare Part B Premiums have gone up $1.50 from 2018. Premiums will be $135.50 a month.

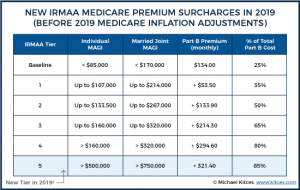

- Annual income rates have increased; if your income was greater than $85,000 single or $170,000 couple, then you will face additional costs for Medicare Part B premiums. About $2.10 more a month.

The day before the Medicare rates were announced, the Social Security Administration had its own announcement. The Administration set a 2.8% cost-of-living adjustment, COLA, to 2019 social security benefits. Thanks to the “hold harmless” provision, almost 2 million Medicare beneficiaries will not have to pay the full Part B monthly premium payments of $135.50. Hold harmless is the guarantee that a Medicare beneficiary receives limiting how much their Part B premiums can go up. The premiums can not be greater than the increase in their Social Security benefits. However, this only applies to 3.5% of Medicare beneficiaries. So what are the rest to do?

Plan Ahead

Even though the costs have increased only by a couple of dollars a month, the $2 can add up throughout the year. It can change the budget for a lot of people, and some will be struggling to fit it into their budget. If you are one of these people who worry how you are going to pay these extra costs, then looking into a Medicare Supplement plan would be beneficial. There are 10 different kinds of Medicare Supplement plans that you can look into. Most of these plans will pay the deductibles and copays, and offer extra benefits that Original Medicare does not offer.

Researching and comparing the different kinds of Medicare Supplement plans can be frustrating. EZ.Insure offers highly trained agents in your region that specialize with Medicare Supplement plans. They can go over your needs with you, compare plans, and provide you with quotes instantly. To get a quote enter your zip code in the bar above, or contact an agent by calling 888-753-7207, or emailing [email protected]. We make the process easier for you, so you do not have to stress or miss an important detail.