The Centers for Medicare & Medicaid Services (CMS) has finally released Medicare costs for 2021. Knowing these costs will help you decide whether to stick with Original Medicare or buy a Medicare Supplement Plan to help pay for your Part B premiums and costs. Medicare Open Enrollment is still going on, but not for long! It will be over December 7, so read on to find out how you can be better prepared for next year.

Medicare Part A Premiums/Deductibles

Medicare Part A is hospital insurance, and covers things like skilled nursing facilities, inpatient hospital stays, and some home healthcare services. If you are 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years, then you will be eligible for premium-free Part A.

The Medicare Part A inpatient deductible that you must pay when admitted to the hospital will be $1,484 for each benefit period in 2021, which is an increase of $76 from $1,408 in 2020. The breakdown for 2021 is:

- Days 1-60- $0 coinsurance for each benefit period

- Days 61-90– $371 coinsurance per day of each benefit period

- Days 91 and beyond- $742 coinsurance per each “lifetime reserve day” after day 90 for each benefit period (up to 60 days over your lifetime)

- Beyond lifetime reserve days- you pay all costs

Medicare Part B Premiums/Deductibles

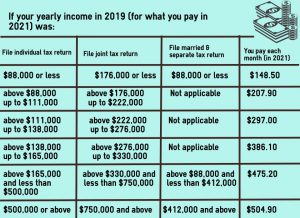

Medicare Part B is medical insurance and covers such things as doctor visits, outpatient hospital services, durable medical equipment (DME), and certain home health services. The government had indicated that Medicare Part B premiums would not increase by more than 25% in 2021. CMS’ announcement has now given us the exact amount they will increase by: Medicare Part B premiums for 2021 will be $148.50, which is an increase of $3.90 from $144.60 in 2020. Your premium amount may be higher depending on your income:

CMS also announced that the annual deductible for Medicare Part B will be $203 in 2021, which is an increase of $5 from $198 in 2020. You will continue to pay 20% of the Medicare-approved amount for most doctor services, outpatient therapy, and durable medical equipment after this $203 deductible is met.

Considering A Medicare Supplement Plan

Although the costs are not going up by too much next year, for some who are on a fixed income or a tight budget, an almost $4 a month rise in premiums can be a lot. On top of that, the 20% coinsurance you will have to pay could increase with the rising costs of healthcare. Luckily there are ways to help pay for coinsurance and save money.

Medicare Supplement Plans are perfect for beneficiaries looking to save money and have more of their medical care covered. There are 10 different Medicare Supplement Plans to choose from, each with different price points and coverage options. If you are interested in looking into these plans but do not know where to start, allow an EZ.Insure agent to help. Our licensed agents work with the top-rated insurance companies in the country and can compare plans in your area in minutes. We will assign you one and only one agent who will go over your budget and medical needs. They will compare Medicare Supplement Plans to find the one that is best for your needs. What’s even better is that all of our services are free! To get instant free quotes, simply enter your zip code in the bar above, or to speak directly to an agent, call 888-753-7207.