The number of adults in this country with congenital heart disease (CHD) has increased dramatically over the past few decades. Currently, there are around 800,000 adults in the United States who have grown into adulthood with congenital heart disease, and this number increases by around 20,000 each year – and many of these adults living with CHD are 65 years and older. So, with people living longer with congenital heart disease, it is more important than ever that older adults know just how important it is to seek the proper medical care to live longer, healthier lives.

Congenital Heart Disease

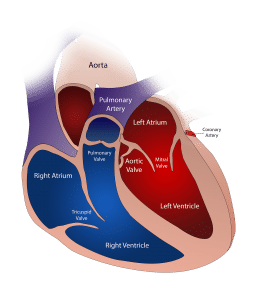

Also known as a congenital heart defect, congenital heart disease is a heart abnormality that can affect:

- Heart walls– The walls between the left and right sides and the upper and lower chambers of the heart might not have developed properly. This will cause blood to back up into the heart, which makes the heart have to work harder.

- Heart valves– The valves inside the heart that direct blood flow can break or close up, affecting the heart’s ability to pump blood.

- Blood vessels– Arteries and veins that carry blood to the heart and back might not function properly, which will reduce blood flow.

Congenital heart disease can be caused by multiple factors that can be both genetic and environmental.

Symptoms of Congenital Heart Disease

CHD can be diagnosed at birth, right after birth, or at any point in your childhood, or even adulthood. You might experience symptoms, or you might experience none at all. Symptoms of CHD can include:

- Shortness of breath

- Poor exercise tolerance

- Poor circulation

- Fatigue

- Chest pain

- Fluid buildup in the lungs

- Cough

- Heart failure

- Lightheadedness

- Swollen ankles, feet, legs, stomach, or neck

Treatment for Adult Congenital Heart Disease

Treatment for heart disease could include long-term medications such as diuretics, vasodilators, beta-blockers, digoxin, and antiarrhythmics. For more serious cases, a catheter might be an option. The catheter is put in between the upper two chambers of the heart to release any clogs in the chambers, and allow blood to flow more freely. Natural tissue will eventually grow in and around the device.

Another option is to have a stent put in. This process involves a catheter with a deflated balloon going in and being inflated to stretch the aorta to lessen blockage. Then, a stent is put in to keep it open.

The last option is to repair or replace a heart valve, expand arteries, unblock valves, or patch holes in the heart with surgery.

Even if you’ve been treated for congenital heart disease, you’ll still need to follow up often with your doctor; otherwise, you risk your condition worsening. According to Dr. Ami B. Bhatt, MD, Director, Adult Congenital Heart Disease Program, Massachusetts General Hospital, “Many older patients who have been treated for CHD in the past have a sense that their heart is better and believe they don’t require follow-up. However, complications can arise from an underlying disease or the procedures that patients underwent as children. Therefore, it’s imperative that these patients recognize the importance of lifelong cardiovascular care.”

If you have congenital heart disease, it is very important to monitor your condition and make sure that your heart is strong, and there are no clogs or issues with blood flow. Remember, when you see the doctor, you will have out-of-pocket expenses, such as your Part B deductible and your 20% Part B coinsurance, which can add up to a lot, so it’s definitely worth looking into a Medicare Supplement Plan to save as much money as you can. Come to EZ and talk to one of our agents: we work with the top-rated insurance companies in the nation and can compare plans in minutes for you at no cost. To get free instant quotes for plans that cover your current doctors, simply enter your zip code in the bar on the side, or to speak to a licensed agent, call 888-753-7207.