As a stay-at-home parent, you don’t always get the recognition you deserve, even though you’ve got one of the toughest jobs around. Not only are you raising children, which is not easy, but you are often the one keeping up with the finances of the household, doing the many loads of laundry, running errands all day to make sure the fridge is stocked, getting your children to and from practice, and on and on. Considering all of this, it doesn’t make sense for only the breadwinner of the household to have life insurance; they might bring home the bacon, but there is so much more that a stay-at-home parent does that contributes to the household. How would your family get by if you were gone?

Don’t sell yourself short or just how much you contribute everyday within your household. In the event of your passing, your spouse or partner will have to take on more roles than before, which can cost them more than expected. They will be grieving your loss, but you can make the process a little easier by continuing to contribute to the household with a life insurance policy. It can help:

Keep The Household Running

You do not get enough credit for all the work that you do around the house, which, on top of taking care of the kids, is a full-time job. If you were to pass, your spouse would need help with the laundry, house cleaning, shopping, cooking, and childcare, since they would most likely be unable to keep up with all of that while working a full-time job. Outsourcing all of this can all be very expensive; in fact, consider this: if you were to pay stay-at-home parents for all the work they do, their annual salary would be roughly $160,000! You contribute a lot more than you think! A life insurance policy will help your spouse cover all of these new expenses and roles, ensuring that they have help even when you’re gone.

Daycare Costs

Since you are a stay-at-home parent, you are the primary caregiver for your children, if you passed, your spouse would have no choice but to put the children in daycare when they return to work. Daycare costs a little over $11,000 a year per child, which is an expense that your spouse might not be financially ready for. You want your children and partner to be able to continue their daily routines and grow, even when you’re gone. Having a life insurance policy ensures your partner can provide top notch child care for your children while also keeping their career on track.

Provide for Your Children When You’re Gone

Are you planning on helping your kids financially when they go to college? Or would you like to help them put some money down for a new house one day? Are you planning on getting a job and making a steady income once they are in school full-time? No one knows what the future holds, but with a life insurance policy, you would still be able to provide all of this financial support, even if you were no longer around.

Pay Off Debts

If you have any loans that your partner co-signed, they will have to shoulder the burden of paying it back. Having life insurance would take the stress off them and provide them with help paying back any of your debts.

Cover Funeral Expenses

Funerals are not cheap. Most people do not have extra money tucked away for an unexpected expense like this, but you can provide that for your family when the time comes. With a final expense life insurance policy, you can make sure your family has money for funeral costs as well as any other expenses, such as medical bills, and more.

Give Loved Ones Peace Of Mind

A life insurance policy will not only give your family tax-free benefits in the event of your passing, but it will also make an incredibly difficult time much easier on your partner and family. Your family losing a parent and partner is tough; they will be grieving, and worrying about future bills and expenses is the last thing they need while finding a way to cope.

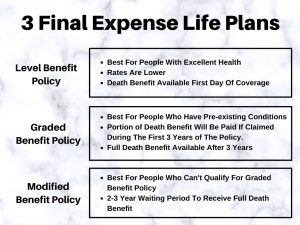

What Kind Of Life Insurance To Get?

When choosing a life insurance policy for your family, it all comes down to your needs and what will work best for them. Do you want a life insurance policy that has cash value you can withdraw and use during your lifetime? Then a permanent or whole life insurance policy is a great option. Do you want life insurance that will remain in effect for your whole life or just for a certain amount of time? If you want a policy that will remain in effect just while you’re paying off your mortgage, for example, a term life insurance policy is perfect. The possibilities are endless, but the best way to determine which is best for you and your family is by comparing plans from multiple companies in your area.

Being a stay-at-home parent is a wonderful – and tough – job. And just because you don’t bring home any actual income, doesn’t mean that the work you do doesn’t play a large role in supporting your household financially. That means that your job is just as important as that of the breadwinner of the family, and so it’s just as important that you have life insurance. When deciding on a policy, consider using online tools to see what’s available, as well as working with an agent who will help you compare plans and see which is the right fit for you. To get you started, we have provided the top insurance companies that offer life insurance policies below; each can give you hassle-free assistance and the most competitive rates in the nation. Always check multiple sites to make sure you have bargaining power and know the advantages of each company. Make sure a hard time isn’t made harder by a financial burden, check life insurance rates today.