When it comes to life insurance, married people have two choices, individual policies or joint policies. Most couples buy separate policies for each person. But for some couples it makes more sense to get a single policy that covers both people. Choosing to buy a policy together you can buy a joint policy or a survivorship policy. A joint policy is known as a first-to-die policy. Meaning that though both people are covered the benefits are paid out when one of them passes.

When it comes to life insurance, married people have two choices, individual policies or joint policies. Most couples buy separate policies for each person. But for some couples it makes more sense to get a single policy that covers both people. Choosing to buy a policy together you can buy a joint policy or a survivorship policy. A joint policy is known as a first-to-die policy. Meaning that though both people are covered the benefits are paid out when one of them passes.

Survivorship policies are called second-to-die insurance, meaning that benefits aren’t paid until both members pass away. Most couples don’t choose survivorship policies because it takes longer for the death benefit to pay out. However, survivorship policies are useful for estate planning and a source of money for children or grandchildren who may always depend on their parents. Below we’ll go into detail about how survivorship policies work so you can decide if one is right for you.

How Survivorship Life Insurance Works

A survivorship life insurance policy can either be a term or permanent policy. A term policy covers you for a certain number of years before you have to renew it. A permanent policy, on the other hand, covers you for the rest of your life as long as you pay the premiums. Most policies for survivorship life insurance are permanent. Most people buy survivorship coverage with permanent whole life or universal life insurance instead of term life insurance.

The reason is simple: most couples who buy a survivorship policy don’t want protection for a short time. Survivorship policies don’t pay out until both people who are covered die. So, when the first person covered by the policy dies, the second person must keep paying the premiums to keep the policy going. When both policyholders die, the death benefit is paid to whoever the policyholders named as their beneficiary. Permanent life insurance builds up cash value that can be used if necessary.

Reasons To Have A Survivorship Policy

Estate Planning

Typically couples with a high networth often buy survivorship life insurance so that their children will pay less in estate taxes once they pass away. When the first spouse dies, the other spouse will not have to pay taxes. However, if their combined assets are worth more than the federal exemption level, beneficiaries have to pay federal estate taxes once the second spouse dies. There are currently 12 states plus the District of Columbia that have even lower estate tax thresholds. And 6 states have inheritance taxes. If both spouses die at the same time, a survivorship policy can help pay estate taxes and other costs immediately. It can also help make sure that the beneficiaries get an equal share of the assets. Especially if the assets, such as a family business, are hard to sell.

Business Succession

Survivorship policies don’t necessarily have to be a married couple, it can be any two people, even business partners. When both business partners pass away, a survivorship policy can give the money needed to transfer the business to its new owner. If there is more than one new owner, the death benefit can be split amongst each of the business partners to make sure there is enough money to take over the business.

Caring For Permanent Dependents

If you have a child with special needs or another person who will always depend on you. A survivorship life insurance policy will make sure that you leave enough money for them to be taken care of for the rest of their lives. The money from the policy could be put into a special needs trust. So, that if both parents die, the child will still have some money.

Coverage With Medical Issues

When one spouse can’t afford individual life insurance because of a medical condition, but the other is in good health, a survivorship policy can be a cheaper way to get coverage.

More Affordable

Most of the time, buying a permanent life insurance policy can cost five to fifteen times as much as buying a term life insurance policy. But permanent survivorship life insurance policies can sometimes be cheaper in the long run than buying two separate policies.

You Need Cash Value

Survivorship policies can be set up so that the cash value of the policy helps the spouse who is left behind. Even though the death benefit won’t be paid out until both of the policyholders have died. Some permanent policies can build up a cash value that can be used while one of the spouses is still alive. If the policy builds up enough cash value, the surviving spouse can take out a loan from it to pay for funeral costs or policy premiums while the policy is still in force.

Policy Costs

In general, it costs more to buy two separate $1,000,000 policies than to buy a single $1,000,000 survivorship policy. It’s easy to see why. With two separate permanent policies, insurance companies have to plan for a total payout of $2,000,000. However, when two people are covered by a single life insurance policy, the total payout is only half as much. Individual life expectancy is also longer than joint life expectancy, since one insured person usually dies after the other. This means that second-to-die policies may be cheaper than first-to-die policies. But the actual cost of a life insurance policy can vary a lot depending on many things. Such as age, health, lifestyle, type of insurance, and the insurance company. Riders are extra features that can be added to a policy to make it fit the needs of the policyholder. Here are some examples:

- Estate Preservation Riders – These are used for tax planning purposes when extra death benefits may be needed in the first few years of the policy.

- Level Term Rider – Provides extra coverage for each insured person up to age 95. The rider, which each insured person must apply for on their own, can usually be changed to a whole-life policy if it is done before a certain age.

- Monthly Deduction for Death and Disability Waiver – This benefit, which only applies to one of the insureds. Can help make sure the policy stays active by waiving premiums if the couple’s income drops because of death or disability.

Survivorship Pros and Cons

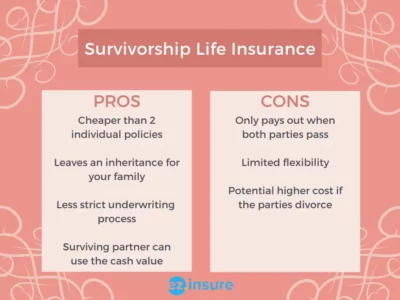

A survivorship life insurance policy can help you and your spouse take care of your family after you’re gone. However, this type of life insurance has some drawbacks. Before you buy a life insurance policy, you should think about the pros and cons to see if it’s the right choice for your family.

Pros

When deciding on a survivorship policy, most couples think about how much it will cost. Whether it’s first-to-die or second-to-die. The premiums on a joint policy are likely to be more affordable than the premiums on two separate policies. First-to-die policies cost more money than second-to-die policies. The ability to make your inheritance equal is another benefit of a survivorship policy. Forbes says that if you have more than one beneficiary, you can set up the policy through a trust that will divide your death benefit equally among all of your dependents.

Lastly, the process of getting a survivor policy is less strict than getting other types of life insurance. This means that if you or your spouse have health problems that might keep you from getting a traditional life insurance policy, you may still be able to get coverage through a survivorship policy.

Cons

Most couples think about how much it will cost when they choose a survivorship policy. Whether it’s first-to-die or second-to-die, the premiums on a joint policy are likely to be cheaper than the premiums on two separate policies. Policies that pay out more when the first person dies are called “first-to-die” policies. A benefit of a survivorship policy is that you can make sure that everyone gets the same amount of your inheritance. Forbes says that if you have more than one beneficiary, you can set up a trust that will divide your death benefit equally among all of your dependents.

Lastly, it’s easier to get a survivor policy than it is to get other types of life insurance. This means that even if you or your spouse have health problems that might keep you from getting a traditional life insurance policy, you may still be able to get coverage through a survivorship policy.

Life Insurance With EZ

Not sure what kind of policy you need or where to start? You have to compare plans to find the best one for your needs because there are so many different kinds of life insurance. You could use online tools or talk to an agent. Everyone has their own needs, priorities, and ways they can spend their money. At EZ.Insure, we know that you and your family want the best coverage. But we also know you have to stay within your budget.

So, we will do everything we can to find you the best policy at the best price. And we want to make it as easy as possible for you to do so! We’re here to help, and the best part is that everything we do is free. We will help you with everything, from answering all of your questions to helping you choose a policy and finish the enrollment process. We will also help you after your plan has started. To get started, just type your zip code into the bar below or give us a call at 877-670-3560.