Life insurance is a great asset for your family. But it’s only natural that one of your main concerns when searching for a policy might be “how much is it going to cost me?” The answer to that question will actually depend partly on what is known as your health rating: life insurance companies will determine your health rating by gathering facts about your health history, age, family history, and other factors. Once they do this, they will put you in a category, which will determine how much you will pay for your life insurance policy. Understanding how these ratings work, and what they mean for your policy, will help you figure out how much you can expect to pay, and which type of policy is best for your needs and budget.

What Are Life Insurance Health Ratings?

When you apply for a life insurance policy, life insurance companies will take into consideration a whole host of factors when determining your premium price, including your driving record, the results of a medical exam, and even your criminal record. These factors, as well as your health and family health history, will determine your health rating.

Why do life insurance companies use health ratings? Well, they want to know how much of a risk you are to insure before they approve you for a policy, and that means knowing how healthy you are and what your anticipated life expectancy is. If you are in poor physical condition and likely to pass away sooner due to health conditions, such as cancer, you are a high risk for them to cover. On the other hand, if you are healthy, you are a lower risk and can get a lot of coverage for lower rates.

Types Of Life Insurance Health Ratings

Health ratings range from low to high. If you are not healthy, you will have a lower rating, and if you are in great condition, you will have a higher rating; the higher your rating, the lower your premiums will be. Life insurance companies generally have two sets of ratings: regular ratings, and tobacco-user ratings.

Non-Smoker Regular Ratings

- Premier/Premium/Preferred Plus or Preferred Best– This is the best type of rating you can get. If you are in excellent health, are not taking medications, and are a healthy weight, you can qualify for this rating class, and will have the lowest premium rates.

- Preferred– If you are in great health, but have some health issues, such as slightly higher blood pressure or cholesterol that is above average, but your issues are controlled with medication, and you are a healthy weight, you can qualify for this rating class. You will also qualify for this rating if your family has a history of cancer, or other diseases, but you are otherwise in excellent health.

- Standard Plus– You will qualify for this rating category if you have health issues that are more serious than those allowed with preferred ratings, such as high blood pressure or if you are slightly overweight, but are otherwise in very good health and have no family history of diseases.

- Standard– If you are in average health, you will qualify for this rating. Under this rating, you can have health issues like being significantly overweight, high blood pressure or cholesterol, and if you need to take medications regularly. You will also be in this category if you have a family history of cancer or other serious diseases.

Smoker Ratings

- Preferred Smoker– If you are a smoker, but are in relatively good health and would otherwise qualify for the preferred non-smoker category, you will probably be placed in this rating category.

- Standard Smoker– This rating is given to those who smoke and have other risk factors or illnesses that are controlled by medications.

Changing Your Health Ratings

The good news is that once you’ve been given a health rating and purchased your policy, your rating can not go any lower even if your health deteriorates. This is why it’s important to purchase a life insurance policy when you are younger and healthier!

On the other hand, you can improve your rating even after you’ve purchased your policy if you address some of your health issues, and do things like bring your high blood pressure or cholesterol down, or quit smoking. If you do these things, you can ask your life insurance company to reconsider your rating; you will then have to undergo another medical exam. For example, if you inform your insurance company that you have been tobacco-free for at least 12 months, they could upgrade your rating, and offer you lower premiums, if you pass a medical exam and give them a clean urine sample.

You should also consider dealing with any health issues before applying for life insurance so you can get a better rating from the start.

If you’re wondering how much you might pay for a life insurance policy, the best thing to do is to start comparing plans from different companies. Not all insurance companies follow the same underwriting guidelines, and some might consider a health condition less serious than another does, so rates can vary from insurance company to insurance company. That means finding the best policy for you can be tough, but you can do it, with some help from an agent who specializes in life insurance, and who can help you compare plans.

We have provided the top life insurance companies in the nation below; each offers hassle-free assistance and the most competitive rates. Always check multiple sites to make sure you have bargaining power and know the advantages of each company. Make sure a hard time isn’t made harder by a financial burden, check life insurance rates today.

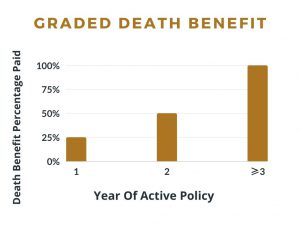

One of the major differences between graded death benefit policies and other types of policies is that the death benefits are paid out in percentages; after each year of having an active policy, your beneficiary will receive a higher portion of your death benefit:

One of the major differences between graded death benefit policies and other types of policies is that the death benefits are paid out in percentages; after each year of having an active policy, your beneficiary will receive a higher portion of your death benefit: