Product liability insurance is an essential form of protection for businesses who produce, distribute or sell goods and products. Regardless of how careful you are when producing or selling items, accidents happen. If an accident does happen to occur and it involves injury, damage or defects relating to your product, you could be held liable.

Fortunately, with the proper product liability insurance policy in place, you’ll instead be protected against the financial repercussions associated with the product-related claim. To help you get ahead of these types of potentially costly issues we’ve developed a simple guide explaining what product liability insurance is, risks it protects againsts, and why it’s so important for your business.

What is Product Liability Insurance?

Product liability insurance is a specific type of coverage intended to shield companies against lawsuits pertaining to goods they manufacture, sell, or distribute. These claims usually occur when a product injures a customer, damages their property, or has a flaw that results in harm. This insurance also covers the legal fees related to defending your company.

What Does Product Liability Insurance Cover?

Here are some of the main areas that product liability insurance generally covers:

- Consumer Injuries: If a customer sustains injuries as a result of a flaw in your product’s design or function.

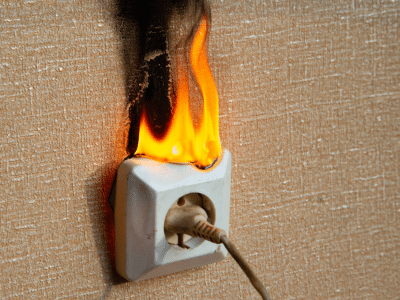

- Property Damage: Product liability insurance pays for the necessary repairs if your product causes harm to someone’s property.

- Defective Products: This insurance covers claims against your business if a product is defective due to a manufacturing error or incorrect labeling.

- Legal Defense: Attorney fees, court costs, and any other expenses associated with defending your company in a lawsuit are all included.

- Payouts for Settlements: If your company is held accountable for an accident, the insurance pays for the settlement or additional compensation owed to the impacted parties.

Why Your Business Needs Product Liability Insurance

In today’s day and age, lawsuits are quite common. Even the smallest problem with a product can result in an expensive lawsuit. While it’s important to always operate your business carefully with the proper safety measures in place, unexpected errors still happen. Without the right coverage, costs could overwhelm your company so much that you’re forced to take out loans or even worse, shut down for good.

The Risks of Selling Products

To help underscore the importance of product liability insurance, let’s examine some of the common risks involving products and goods.

- Manufacturing Defects: Production mistakes resulting in the sale of hazardous or flawed goods to customers.

- Flaws in Design: Even when dealing with high quality materials and top-of-the-line engineering, design flaws are possible and can put users at risk of injury.

- Inadequate Labeling or Lack of Warning: Accidents or injuries stemming from mislabeling, or missing safety warnings result in your business being held liable.

A study from the Insurance Information Institute found that the average cost of a product liability claim can range anywhere from tens of thousands to millions of d

ollars, depending on the severity of the damage. Without product liability insurance these costs have the potential to devastate your business, even if they’re on the low end of the average cost scale.

How Product Liability Insurance Protects Your Business

This coverage serves as a financial safety net, covering the costs of legal defense, medical bills, and future settlement payouts. No matter if you’re a small or large business, the impact caused by product-related lawsuits can be extremely costly without the right insurance in place. Here are the main protections that product liability insurance offers:

- Legal Costs and Fees: If a lawsuit is filed, the cost of legal representation can mount quickly. You won’t have to pay for your defense out of pocket thanks to product liability insurance, which covers these expenses. Also, product liability covers any additional lawsuit fees.

- Medical Expenses: If a consumer sustains injuries because of a flaw in your product, insurance pays for their medical bills

- Settlements and Payouts: A product liability policy will also cover the settlement and payout costs, if your company is found liable for a product defect.

Real-World Example: In 2017 there were multiple court cases involving exploding smartphone and electronic-cigarette batteries, where consumers were injured due to faulty equipment. In one case, the claims and defense costs totaled over $200,000. Luckily for the company at hand, their product liability insurance covered the expenses.

How to Get Product Liability Insurance

Getting product liability insurance for your business is a pretty straightforward process. First, you must consider the variables that affect your coverage. Insurance companies usually take the following factors into account when estimating premiums costs and the necessary level of coverage:

- The Types of Products You Sell: Different types of products come with different levels of risk. For example, common household items like a table, come with far less risk than electronic or medical devices. If the products your company offers have high risk levels, it’s crucial to invest in product liability protection.

- Sales Volume: The higher volume of products that you sell, means the higher chance that a product-related incident will occur. This increased risk may affect the cost of your insurance premium.

- Business Size: The size of your business may also affect the monthly premium cost for product liability insurance. In general, premiums will be cheaper for smaller companies in comparison to large corporations.

Once you’ve taken some time to consider these factors, the next step is to work with a trusted insurance provider such as EZ.Insure. EZ.Insure’s process makes getting matched up with a quote and quality insurance plan quick and simple. With the help of our coverage comparison tools and expert insurance agents , you can get the coverage your business deserves!

In a Nutshell

For business selling, manufacturing or distributing goods, product liability insurance is a must. This essential coverage shields your company from costly financial risks stemming from product-related claims. Whether it’s legal fees, settlement costs, or medical bills, product liability has got your back.

Just because you haven’t had any product-related accidents yet doesn’t mean they can’t occur. Instead of wondering what might happen, be proactive by preparing for the unexpected. To take the next steps and get a free product liability insurance quote, just visit EZ.Insure and enter your zip code, or call us directly at 855-694-0047.