Climate change has been a hot button issue for a while now, and the debate is only getting worse. While NASA scientists are still working on the culprit, recent disasters have been a direct influence on a rise in insurance rates.

Basically, our weather seems to only get hotter each year, causing more intense storms, and while the rates slowly climb, people can only pay for so much. With insurance needed more than ever, we are left to wonder how it will play out.

Global Warming

Scientists create future climate models to predict the weather. Research like this can help save lives by warning people before storms even form. With these studies, scientists find that greenhouse gases are the most rational culprit for the storms we’ve seen.

With more gas in our atmosphere, scientists predict that the planet’s overall temperature will rise. Everything besides the greenhouse gas evidence is just conjecture. However, future predictions lean towards stronger winds, bigger storms, and increases in droughts. Areas like the continental US are already feeling the effects.

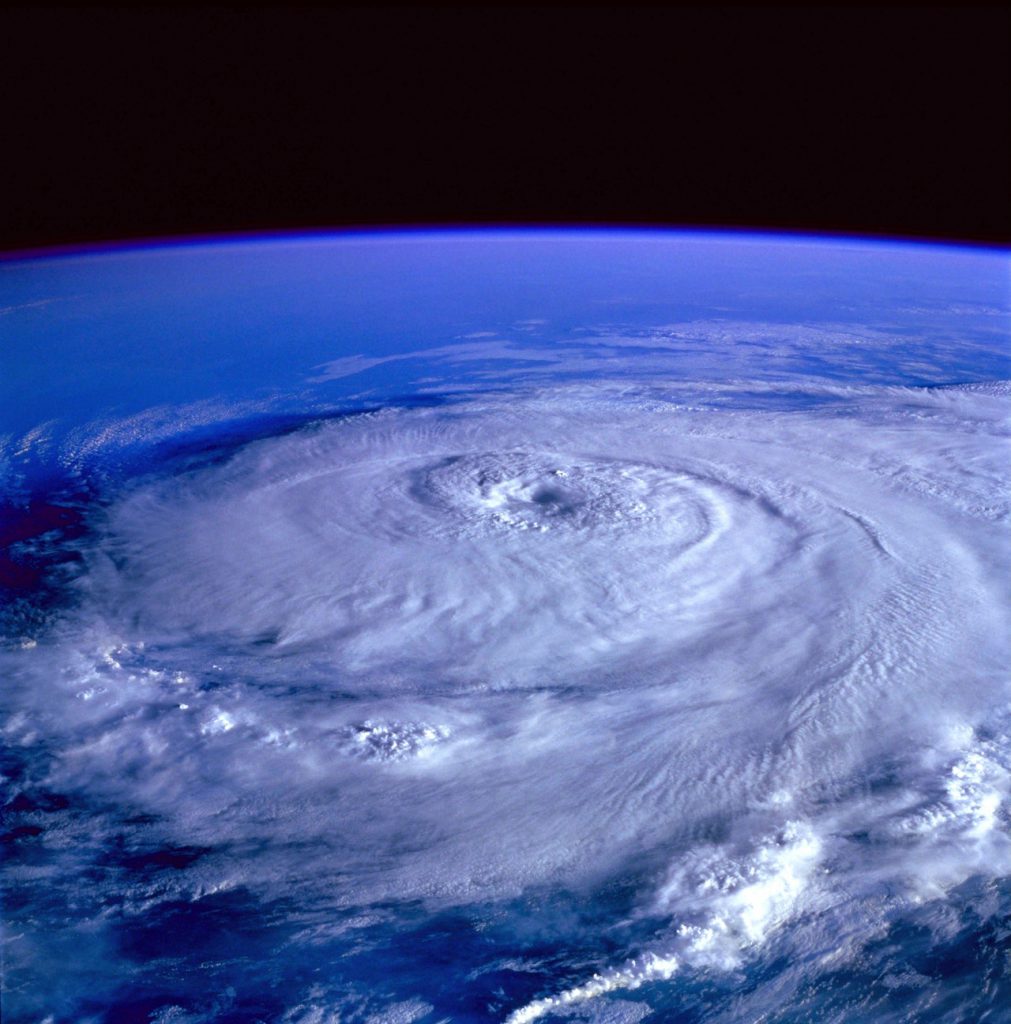

While the temperature is what we have evidence for, storms are the main issue here. Global warming will decrease the temperature difference between the poles and the equator, causing a decrease in storm formation. These findings are from research at both Columbia University and NASA’s Goddard Institute for Space Studies. At first, this seems like good news.

However, with the temperature changes come more water vapor. As our atmosphere becomes more humid, the number of powerful storms rises. This means we may see less rainfall, and when it does come, it’ll be more on par with catastrophic weather patterns.

Hotter temperatures will also increase hurricane ranges as the weather creates an easier travel route for the storms. More places inland and higher from the equator are affected by the terrible storms, and they won’t be ready for them like currently affected zones.

One other effect of the temperature rising is coastal flooding. Melting ice caps and glaciers can cause a rise in sea-level, terrorizing a coastal populace. While it is still a theory under inspection, the research is strong enough for insurance companies to start looking into risk management.

Our Insurance Costs

Traub Lieberman Straus & Shrewsberry LLP and Aspen Re recently published a white paper detailing current issues for the insurance industry involving climate change. They’ve found that 2017 was the most expensive year for insurance companies involving catastrophic weather. Loss estimates, they claim, totaled $140 billion that year.

Overall temperature increases for the future, even of just 1℃ could rocket these loss estimates even higher. Their 3.7℃ prediction as the extreme would see totals climbing to $551 trillion.

Rostin Behnam, sitting on the Commodity Futures Trading Commission, plans on forming a panel of experts to address these issues. However, studies for how these issues affect our financial sector have been put on the backburner as our current administration ignores the scientific empirical evidence.

What Can We Do?

Like most overhead issues, we must keep them at hand. For these rising insurance costs, California already feels the damages from its recent terrible wildfires, and Texas with the flooding issues affecting the Houston area. These are only small disasters compared to America at large and even the globe. Really, the only thing at a personal level someone can do for global warming is turning to a vegan diet or recycling.

We need to understand how the market affects our policies. As catastrophic storms increase, so do damages to people’s homes as well as medical expenses. Our government handles most widespread insurance policy changes.

So, the only task we can do as citizens is to pay attention to whom we are electing, and make sure that our representatives understand the current insurance crisis. You can call or email your representative so that they know this is an issue for their constituents.

Bottom line: We may have skyrocketing insurance claims and the companies may not have the capital to pay it off. We must keep up to date with current insurance laws and work with the companies to write better legislation.