‘Tis the season again… so what does the thought of the approaching holidays conjure up in your mind? Families blissfully singing carols around a roaring fire? Dinners with loved ones, parties with friends? Children excitedly ripping open presents? How about a credit card bill a mile long? If it’s the latter, you’re certainly not alone. After all, only the first thing on that list is at least sort of free, so many people find themselves reaching for their credit cards and racking up debt every year as the holidays approach. And that debt could even be haunting them next year like the ghost of Christmas future: in fact, a quarter of American parents were still paying off 2019 holiday debts by the time the 2020 holiday season rolled around.

It’s undeniable: the holidays can be stressful in a lot of ways, and adding money woes into the mix can suck all the joy out of the season. So, we’d like to suggest that right now, even before the holidays are in full swing, ‘tis the season to figure out how to avoid going into debt before the spending frenzy begins.

The Holiday Spending Frenzy

We weren’t kidding when we said that you’re not alone in having nightmares about post-holiday credit card bills: during the 2020 holiday season, around a third (31%) of all consumers took on debt to pay for holiday expenses, and the average amount of that debt was $1,381.

That’s a six-year high, according to MagnifyMoney, up from $986 in 2015, an increase of nearly $400, or 40%. Not only that, but more than three-quarters of people polled by MagnifyMoney said they probably wouldn’t pay off their balances in full by at least the end of January, which means they also racked up interest charges on those bills. 58% said they would take at least 3 months to pay them off, and 15% said they would only make minimum payments, which would mean taking more than five years to pay off their debt, while racking up more than $600 in interest charges (assuming an interest rate of about 15%).

And all of this debt is wearing us down: according to a survey conducted by Credit Karma in 2019 (so before we even had more stress and financial worries brought on by the pandemic), almost half of Americans (45%) said they felt a huge amount of stress as the holidays approached, resulting in more arguments between loved ones (25% of respondents said they argue with their significant others about going into debt leading up to the holidays), and even debt secrecy. Almost all (90%) of those surveyed who planned to take out a loan for the holidays also planned to keep it a secret from friends and family.

So why bring such stress, shame, and strife upon yourself at a time that’s supposed to be full of love and togetherness? We get it, there’s a lot of pressure to give gifts and try to please others, but there are ways to keep spending under control, and help you put the joy back into the holiday season.

How Can You Keep Spending Under Control?

While, according to that Credit Karma survey, 43% of Americans feel that going into debt during the holiday season is unavoidable, it doesn’t really have to be – right? Right! You can do this! Try the following steps to keep your debt to a minimum this year:

Set a Budget – and Stick to It!

According to surveys over the last few years, a bit more than half of Americans generally have good intentions when it comes to their holiday debt, and set a budget for their spending. But it looks like only a little more than 60% end up sticking to that budget – and those who don’t set a budget at all tend to rack up on average at least a hundred dollars more in debt!

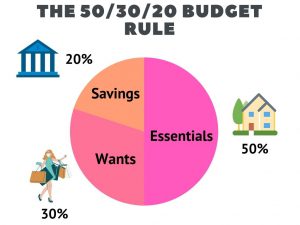

Sure, it can be tough to set a realistic holiday budget, but you can do it if you make it a part of your overall household spending/saving plan. For example, try this: use the 50/30/20 rule, meaning that your aim is to spend 50% of your money on necessities (food, housing, etc) and 30% on fun and extras, with the final 20% being available for paying down debt or being put into savings. So how can this help with holiday budgeting? Well, you can further break down that 20% in smaller categories, and allow 5% of it to go towards holiday spending.

In addition, when you’re working out your holiday budget:

- Be specific about who you’re buying for and what you’re going to be spending/what gifts you want to buy them

- Talk to friends and families about expectations regarding spending on gifts, and consider setting limits

- Consider setting up a secret Santa, white elephant party, or gift exchange, so everyone can buy fewer gifts, and stick to their budgets – after all, it’s about being together, right? Not who can give the most gifts!

Track Everything and Account for Everything

It’s important to keep track of everything you’re spending, so keep receipts and log everything in a running list, adding up as you go. It’s far too easy to rack up more in spending on presents than you think you are.

But with that being said, remember to add up everything that can be considered out-of-the-ordinary holiday spending, not just the cost of presents. Don’t forget to account for gas/travel expenses, cards and postage, decorations, food, etc.

Keep Your Eyes Peeled for Deals

Who says you have to cram in all of your holiday gift shopping during the holidays? Look for sales year round, and you might end up with some great deals on gifts. Missed that boat and now the holidays are creeping up on you? You can:

- Search the web for coupon codes (check out sites that specialize in making lists of available codes)

- Make sure you take advantage of price matching on purchases

- Try outlet stores

- Look for totally unique items at consignment shops or flea markets

- Regift! Hey, there’s no shame in that – if you’re not going to get any use out of something, why let it go to waste?

Consider Ditching the Cards (at Least Sometimes)

Studies have shown that consumers spend less when they’re paying in cash than when they’re paying by credit card, so consider leaving the cards at home sometimes and using cash so you can keep better track of what you’re spending. After all, it feels a lot different to see 20-dollar bills flying out of your wallet than it does to swipe a piece of plastic! If you are going to go for the convenience and safety of credit cards, make sure you’re using them when you have money in the bank to back them up.

And if you’re having a hard time breaking up with your plastic, try thinking about it this way: if your card’s APR is 20%, then a $100 purchase is potentially a $120 purchase if you don’t pay it off right away.

When You Do Use Cards, Take Advantage of Their Features

If you are going the credit card route, make sure to take advantage of any and all features that your cards offer. For example:

- Check to see if your card offers a price protection feature, which will allow you to get a refund if the price of an item charged on your card drops during a certain time frame.

- If you carry a balance, some credit card companies will actually agree to lower your APR if you talk to them, so don’t be shy about contacting your company and giving it a shot.

- Use a card that offers rewards or cash back and save them up for your holiday shopping.

The holidays are a time for family, friends, and yes, splurging a little – but they shouldn’t become a financial burden and a source of stress. With some careful planning and budgeting, and a few simple strategies, though, you can keep everything about the holidays merry and bright, and celebrate the New Year without the weight of debt on your shoulders.