2020 hit many of us hard. Even those of us who did not suffer physically from the coronavirus were touched psychologically by the effects of the pandemic. Many people were also affected financially by all of the state and local shutdowns and business closures that the pandemic triggered. But while many people lost their jobs and have been struggling financially, the strange truth about this unusual recession is that many people have actually saved more money this past year than they ever have. So the question for many of us becomes: after this crazy year, are you and your wallet ready to go back to “normal”?

Changing Habits

What have you been missing over the past year? Going to restaurants or the movies, or taking trips? Well, all of those little things that we used to do without thinking all added up to a lot of discretionary spending, and, since we haven’t been doing those things as much, that spending has decreased. For example, with fewer Americans commuting or taking car trips, spending at gas stations went down roughly 30% during the pandemic. And spending at bars and restaurants? That plummeted by over 40%. As some people have joked, their budget for entertainment, clothes, and gas added up to $0 a month during the pandemic, while their monthly grocery bills soared to $1500.

So, for people lucky enough to have kept a steady income throughout the pandemic, what has this shift in spending habits meant? It might have been bad for many small businesses, but the numbers show it has actually been good for Americans’ bank accounts. Consider this: while traditional budgeting advice often suggests aiming to save 20% of your income, in December 2019, the U.S. personal savings rate (the percentage of national personal income people saved in any given month) was 7.2%. In April 2020, that number skyrocketed to 33.7%!

It’s unheard of for the personal savings rate to soar above the suggested 20%, and, while it hasn’t stayed that high, it was still at 20.5% in January 2021 – over 13% higher than just a year before! According to Anand Talwar, a deposits and consumer strategy executive at Ally Bank, “When consumers feel or see risk, they change their behaviors and stockpile or change their spending habits. We saw some really dramatic changes in certain kinds of things when the pandemic first started. For some folks, behavior might be forever changed.”

Budgeting As We Move Forward

Have you changed your spending and saving habits over the past year? For many, it wasn’t really by choice, since many things to spend disposable income on simply weren’t available or necessary. But are you busting to break out your wallet and get spending again? Do you agree that, according to Mike Kinane, head of consumer deposits, products, and payments at TD Bank, “As we get through the vaccine [and] start to see consumers being able to get back to normal, I do think we’re going to see a bit of a return to normal. There will be a pent-up demand for sure.”

It seems like people are ready to start spending again; in fact, one recent survey found that just over half of Americans plan to “splurge” after the pandemic, with most of those people (20%) saying they’re going to put their saved money towards a vacation. And, while it’s totally understandable to want to live it up a little when we’re once again able to, you also need to think about how you can hold onto some of your extra savings and how you can budget going forward.

To keep yourself on track now, and in the future, you should:

- Compare your spending and analyze where you are now – It’s definitely not the most exciting way to spend your afternoon, but it would be wise at this point to look at what you spent your money on and how much of it you saved in 2019, the last year of normalcy. Then, go through all of your accounts for this past year and see what you’ve been able to save and what debts have piled up. How different were those two years? This comparison will give you a good idea of what to expect when we return to “normal” (whatever that might be), as well as show you if you can put more money towards your savings, or if you need to cut down on spending in certain categories. Here’s a tip: try using a budgeting app to help keep you in the know about what you’re spending your money on!

- Stay smart about debt – It might be tempting to take advantage of all of those 0% interest deals on big purchases floating around out there now, but remember: debt is always a liability. Don’t let those “deals” tempt you into spending money on something you weren’t actually planning to spend money on. Whatever you borrow, at whatever rate, you always have to pay it back! So instead of offsetting your savings with extra loan payments, take advantage of low interest rates by:

-

-

- Refinancing your home – Just remember to check the fees and try not to extend the life of your loan.

- Speaking with your credit card companies – If you’re a customer in good standing, try calling them to see if you can get your rates lowered. Or, consider transferring your balance to a card with an 0% interest offer – just remember to have a plan to pay off the balance during the promotional period!

-

- Examine your household expenses and see what you can trim – With a return to “normal” spending finally in view, now’s the time to try to reduce some of your bills. Look at your spending on:

-

-

- Streaming services – Sure, it feels vital to have 8 different streaming platforms right now, but do you really need all of them? Take a look and decide which ones you really use, and consider ditching the rest.

- Cell phones – Big name service providers are always changing their deals; in addition, there are tons of budget options available now that often use the same networks but charge only around $35 – 40 a month.

Call your car insurance company and see if they are offering any discounts that can help you save more money. - Internet – If you’ve got a few different options in your area for internet service providers, call around and see what promos they’re offering – and don’t be afraid to play them off of each other!

- Car insurance – Many insurance companies have been offering rebates and discounts for the past year, since people have been driving so much less. See if your company is offering any discounts, or if they can get you a better rate. If not, shop around, or consider lowering your premiums by raising your deductible.

-

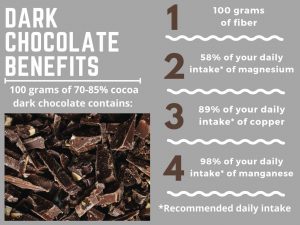

- Don’t go crazy! – Yes, going out to restaurants is great, but it’s also way more expensive than eating at home. As things start to reopen, enjoy yourself but then remind yourself how much money you saved by eating at home. Splurge now and again, but then try to offset your spending on food by bringing your lunch to work (or preparing it at home if you’re still working from home) or cutting out those daily coffee runs.

No doubt about it, the last year has been rough. But let’s also try to focus on the positive! Maybe you’ve read all those books you’ve been meaning to read, maybe you’ve become an expert baker, or maybe you’ve just learned to appreciate time with friends and family. And maybe, just maybe, you were lucky enough to be able to put some money aside for a rainy day – because now we all know how easy it is for a storm to hit. There is hope on the horizon, so keep up your good habits and start planning for what’s next!