Does anyone out there remember the old days of dating? Being set up with a friend of a friend, or locking eyes with someone cute across a crowded bar and striking up a conversation that leads to numbers being exchanged? We’re sure that there are still some people who find dates the old-fashioned way (well, maybe minus the crowded bar these days), and that fate simply drops an ideal partner in the path of some lucky people, but for an increasing number of people, finding a date means heading online.

Apps like Tinder, Bumble, and OkCupid have given people a seemingly endless array of singles to meet, and that can be great if you’re trying to play the number games when looking for the perfect new partner. But does being spoiled for choice when dating have a downside? Can having so many options actually make it harder to find the right person? And once you start making matches, when do you stop looking?

The Numbers Game

If you look at the numbers, it seems like people have started to turn away from the traditional ways of finding dates, or have begun to lose faith in them, and have been heading online more and more. After all, according to a 2021 survey by the dating site eHarmony, if you’re set up on a date, you only have a 17% chance that you will like the person you’re set up with. Not only that, but only 9% of women report finding a relationship at a bar or club, with only 2% of men saying they found a relationship that way.

Compare that with statistics cited by eHarmony that show 20% of current, committed relationships began online, as well as a 2019 study published in the Proceedings of the National Academy of Sciences that found that heterosexual couples are more likely to meet a romantic partner online than through personal contacts and connections. That study showed that around 39% of heterosexual couples reported meeting their partner online, compared to 22% in 2009.

Those numbers give us an idea of how couples have been meeting recently, but what does the landscape look like if you’re firing up your online dating profile now? Once you head online, you’ll probably find what can feel like an endless stream of people to swipe through – and the numbers back that feeling up. Just take a look:

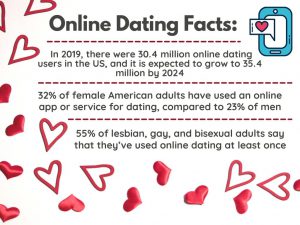

- As of 2019, there were 30.4 million online dating users in the US. This number is expected to grow to 35.4 million by 2024.

- A Pew Research Center study conducted in October 2019 found that 30% of Americans have used online dating, compared to just 11 percent in 2013.

- 32% of female American adults have used an online app or service for dating, compared to 23% of men.

- 55% of lesbian, gay, and bisexual (LGB) adults say that they’ve used online dating at least once.

- Among single LGB people who are looking for dates or relationships, 37% currently use online dating.

Whether it’s your idea of a great way to meet a romantic partner or not, it’s clear the numbers are there, and that can work in your favor. As licensed marriage and family therapist and relationship expert Lisa Marie Bobby, Ph.D. points out, “While online dating has some potential for pitfalls compared to meeting people in real life, the volume of possibilities is much higher. That increases the chances that you’ll meet someone you’re truly compatible with.”

Choices, Choices, Choices

So maybe it’s worth it to get finger cramps from all the

scrolling, and to deal with the superficiality of some people, and the frustrations of ghosting, because you are definitely bound to get matches, and to hopefully start moving your dating life off the screen and into real life. But as you get the ball rolling, you might notice something kind of interesting about the way you interact with the apps that you’re using (because most people use multiple apps to find as many potential matches as possible).

It might start to feel like you’re staring at a menu the size of a book, where each dish and dessert sounds like an appealing possibility…until you see the next one. It turns out, when it comes to dating options, there can actually be too much of a good thing. In fact, a 2021 study in Computers in Human Behavior “tested the impact of having a wide variety of online dating options on perceived attractiveness of familiar as compared to novel faces,” and found out that having a lot of choices might lead to never actually choosing. This study found that the huge amount of choices available through online dating sites could create an “assessment mindset,” leading people to continually consider alternative partners and feel far less motivated to commit to just one partner.

A study in Psychological Science for the Public Interest agrees. According to this study, while online dating can be good for giving people convenient access to dates, and for helping to filter out unsuitable matches, online dating sometimes “reduces three-dimensional people to two-dimensional displays of information…In addition, the ready access to a large pool of potential partners can elicit an evaluative, assessment-oriented mindset that leads online daters to objectify potential partners, and might even undermine their willingness to commit to one of them. It can also lead people to make lazy, ill-advised decisions when selecting among the large array of potential partners.”

Wow, that’s definitely a downside to the endless choices offered by online dating, if you’re looking for a more meaningful relationship. Of course, all of this is fine if you’re looking for casual dating (and there’s nothing wrong with that), but is the convenience of online dating really suited to finding love? After a while, does it just become quantity over quality?

Advice for Avoiding the Numbers Game Trap

It’s looking more and more like rapidly swiping your way through half the people in your city isn’t always the ideal way to date, unless you’re more interested in the ego boost of matching, starting up lots of chats (which can be fun, or can start to feel like work), or finding casual sex (and even that tempting type of real-world encounter can sometimes be hard to come by in the somewhat lazy world of online dating). But, on the other hand, the numbers are there, and it is hard to find dates IRL right now, so you don’t have to write off online dating completely. What we suggest is the following:

- Narrow down your options – To avoid choice overload, try making your search parameters as narrow as possible, being strict about the age, location, etc that you’re looking for – that will help cut down on options. Try to find other ways to limit the number of potential matches you see, as well, perhaps by giving yourself a per-day limit on your swiping. And, conversely, it might sound counterintuitive, but don’t try to appeal to everyone. Make your profile totally tailored to you, and to what you want, so you don’t end up getting messages from endless people who just aren’t right for you.

- Avoid dating app burnout – Juggling endless chats can really start to feel like you’ve got a second job, and can suck all the fun out of online dating, and lead to those “lazy, ill-advised” decisions that the study above warned us about. It can also lead you to give up entirely. Relationship therapist Rhonda Milrad, LCSW advises, “Set a limit for how many people you will be dating at once. It is difficult and time-consuming to manage the dating process with multiple people. If you start to feel consumed, exhausted, or discouraged, take a break. Delete all your apps and cleanse for at least 30 days. It’s OK to take a break every once in a while. It doesn’t mean you’ve given up completely. You’re just giving yourself a chance to reset.”

- Don’t become a pen pal – Unless you’re looking for someone to endlessly chat with without things going anywhere, try to initiate either a video chat or a meeting with someone that you’re truly interested in getting to know better. You’ll never know if you have chemistry with someone unless you meet them face-to-face – and if you find out it’s just not there, you know you can move on.

- Know when to stop looking – Now we’re not saying you have to – or even should – delete all of your profiles once you’ve had a few dates with someone and things are looking good. But if you do meet someone who there’s some potential with, slow down or even take a break from the furious pace of online match-making. And if things are going really well, have a talk with your new partner about where things are going, so you can both figure out if it’s time to hang up your swiping finger for the time being. And always, always be honest about what you want, and expect the same honesty in return.

If the internet has given us anything, it’s seemingly endless choices, and a great deal more convenience in our lives. In the last few decades, those things have spilled over into even our romantic lives, and that’s not necessarily a bad thing. You just have to be careful to not be so dazzled by all the possibilities that you forget what you’re really looking for.

Have you been dating online during the pandemic? Do you feel like the endless options have helped you in your quest to find partners? Or are you burnt out by it all? We want to hear from you!