The US government and the Centers for Medicare and Medicaid Services, CMS, have proposed an increase in Medicare Advantage payment rates. The increase will be an average of 1.84 percent. This increase is up from the 0.45% that plans got last year from the government. Health insurers will receive these payments to help benefit the seniors eligible for Medicare.

The CMS stated that the average Medicare Advantage payment rate will increase by 3.1% after factoring in how members’ diagnoses are coded by health plans. This makes the increase 2.95% from last year.

Medicare Advantage enrollment data by the CMS shows a growth in medicare advantage enrollees of 9%, nearly 20.9 million in 2018. The estimate is that more than one-third of all Medicare enrollees, or 34%, will enroll in a Medicare Advantage plan.

The percentage insurers receive affects how much they will charge for their premiums and benefits. This percentage also reflects how much these insurance companies will profit. The government pays this percentage to these insurers in order to cover their member’s healthcare costs. So if the insurance companies do not get much of the percentage, then the member’s will not receive as much towards their healthcare costs. This means that the healthcare member will be charged more by their insurer, and have to pay more out of pocket.

With such a large percentage payment proposal coming in 2019, insurers will be able to provide more to their members. Benefits will be extended to their customers to include things like wheelchair ramps and other assistive devices in order to help reduce the effects of major health conditions. These benefits are hoped to help the customers live a more comfortable life and prevent conditions from worsening.

The CMS conducts Risk Adjustment Factors on a regular basis in order to keep track of their enrolled beneficiaries and their needs. These risk factors take part in how they pay for plans based on the beneficiaires needs, so that they can make the exact payments for enrollees with differences in expected costs. The risk adjustment allows the CMS to use bids as a base payment to plans. According to the CMS, the payment increase is based on better use of encounter data, which is information about the care that a beneficiary got from a provider. With this data, they can determine risk scores for plans.

The risk scores for 2019 will be based 75% on fee-for-service data, and 25% based on encounter data. The scoring was based on 85% on fee-for-service data and 15% encounter data in 2018.

The CMS states the payment increase will promote stability and the resources needed to support beneficiaries. “Our priority is to ensure that our seniors have more choices and lower premiums in their Medicare health and drug plans,” said CMS Administrator Seema Verma.

Medicare Advantage has always competed with the traditional Medicare fee-for-service program. But due to the “baby boomer” generation, has increased enrollment in both Medicare and Medicare Advantage. In fact, Medicare Advantage enrollment is at an all-time high right now and continues to gain popularity with high satisfaction ratings.

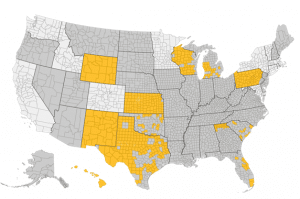

If you would like to find out more about this increase and how it will impact you, EZ.Insure will be more than happy to help. One of our highly trained agents that specialize in your region will help you with all of your Medicare needs. You will be provided with your own personal advisor free of charge to guide you through the shopping process. To get started contact us by email at [email protected] or call 855-220-1144. You can also get an instant quote by entering your zip code in the bar above, it’s that easy.