When you start a new job, you might be offered group health insurance. Employer health insurance is usually cheaper than an individual plan, which is why an attractive benefits plan is such a big deal.

However, the plans they offer could potentially cover less than what you need. In some circumstances, you can (and should) buy health insurance on your own. When making this choice, you have a lot to keep in mind, like what are their differences, and which one is better for you?

Individual Health Insurance Plan

When you look into individual or family health plans, you have the option to compare companies and their plans, then choose which one best fulfills your needs. With private insurance, you have more control over your options. These plans can be bought through the Marketplace, or directly from the insurance company via online, an agent, or broker.

The biggest advantage of an individual plan is its flexibility. This flexibility extends to your career too. You won’t have any formal insurance ties with your employer. That way if you leave or change jobs, you won’t have to worry about losing coverage.

The flexibility also goes with medical networks. You can choose a plan that includes your current doctors and hospitals. After you review your network, make sure you know when to renew or change your plan during the annual Open Enrollment period.

Employer Health Plan (Group Plan)

The biggest pro for employer health is how much they take off your hands. A company will do its own research, comparing the best plans in their area for employees. After purchasing a plan, the employer shares the premium cost with you. What this means is that they can get a better deal for group insurance and then help you pay for it.

As mentioned, this coverage will only be available to you when you stay with the company, so the moment you leave or are let go, the coverage ends. Also note that if their plan doesn’t include your usual doctor, you will have to choose between changing networks, or keeping your individual plan.

Other advantages of a group plan are as follows:

- The company has done the research and picked the plan options already. Group health plans are guaranteed-issue, which means there is no medical underwriting.

- Contributions toward your premium from your employer are not subject to federal taxes, and your contributions can be made pre-tax. This will lower your taxable income.

What It Comes Down To

Deciding whether to seek out your own individual family plan or go with an employer’s can be confusing. Your employer may not offer plan options that suit your needs. There are differences within the price, benefit options, and flexibility, not to mention the overall increase in insurance rates.

Over the years, employer insurance has seen premiums increase by about 3% for individuals and 5% for family plans, while individual health plans have increased by about 4%.

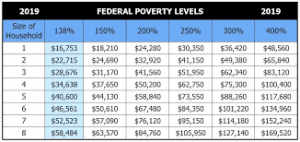

The average annual premium for an employer-sponsored plan is $1,242 for an individual. Compare that to the individual market, which has an average individual premium of more than $5,000 annually. This can be great (and saves you money), but there is a possibility you can find a plan for cheaper on your own.

Individual plans would be the way to go if you want to shop for the plan that exactly matches your needs. That way, you are in control of the costs and the coverage that you get. You will not have to worry about losing your plan if you lose your job or change jobs.

Group plans would be the way to go if you want to save money and are happy with the plan they offer. Their plans are also guarantee-issue, which is great if you have a pre-existing condition. If you seek an individual plan with a pre-existing condition, you can be denied, or it will be expensive. Some employers do offer incentives that lower premiums, such as quitting smoking or getting a gym membership.

All in all, the choice needs to be yours. What it comes down to in the end is what your needs are and the costs. While your boss could offer a plan that you think is too expensive, your individual plan may be even more costly.

Don’t stress out and overthink if you should opt for your employer’s plan or buy your own. If you want to seek what health insurance options are out there, EZ.Insure has your back. We will provide you with a trained agent within your region who can compare all available plans and their costs. This should make the process easier when it comes down to making a decision to go with your employers plan or not. For free quotes, enter your zip code in the bar above, or contact an advisor by calling 888-350-1890, or emailing [email protected]. Life is stressful enough, let us take some of the load off of you.