Americans have been striking and pushing for a higher minimum wage from $7.25 to $15 an hour. Higher minimum wage would have many unforeseen negative effects, especially on taxes and health insurance benefits. With a higher wage for their employees business owners would be less likely to offer benefit packages. The employee would also end up paying more in taxes, adding that to the fact that they would also have to pay for their own insurance and benefits, it might cost more than you think to get that raise.

The problem with raising the minimum wage so much is the funnel of confusion that it creates for already established businesses. Raising the minimum wage means a business would also have to raise the hourly wages for the employees who have been with the company for several years. If they leave their wages the same someone who has been with the company for five years could end up making less than, or the same as someone who just started. This means the business would have to lower their profit margins and take a cut in order to account for paying everyone. For larger businesses this is no problem, but when you look at small business it could be detrimental. For a business that already has slim profit margins they could end up losing money just to pay their employees. This limits the number of employees a business will take on, puts more stress on employees because they can end up understaffed, and prevents any growth in the business. If they also have to take away benefit packages offered to employees because of their new wages this also decreases the likelihood of an employee staying. This in turn could push out unhappy employees creating a higher turnover rate, which costs businesses even more money to interview, hire, and train the right people.

Companies would not only have to limit how many people they hire, they would have to cut back on the healthcare they once offered. According to research, if the minimum wage was increased by $1, then 9-50 percent of the employees wages were offset by a decline in the employer’s health insurance coverage. Employer-provided health insurance would begin to diminish in order to save money. A 2014 study of 400 US Chief Financial Officers (CFOs) by Campbell Harvey, Ph.D., J. Paul Sticht Professor of International Business at Duke University, found that 40% of CFOs would reduce employee benefits if the minimum wage were raised to $10 an hour.

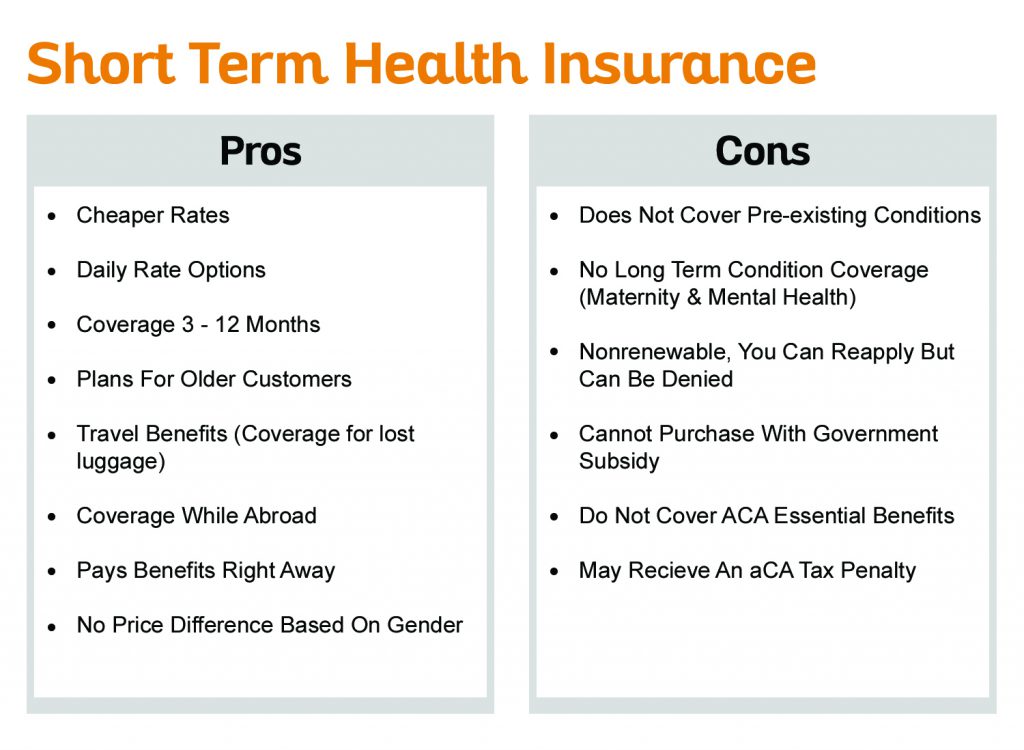

If employers are be less likely to offer health insurance coverage, employees are left to cover their own insurance and studies show employees are less likely to go and get their own coverage through the ACA, even if they were entitled to subsidies. Employees would rather go without coverage than seek insurance from the exchange.

If employers are be less likely to offer health insurance coverage, employees are left to cover their own insurance and studies show employees are less likely to go and get their own coverage through the ACA, even if they were entitled to subsidies. Employees would rather go without coverage than seek insurance from the exchange.

Increasing wages also affects the amount of government assistance people recieve. If someone is working a minimum wage job and is offsetting their income with government programs, tax refunds, and assistance than this wage increase could actually end up costing them more. <You needed an introduction for this. You never mention these affects and just jump into an example about them. For example, a single mother making $7.25 an hour would receive more of her pay than those who made $10 an hour. Raising wages results in that mother losing about $70 in earned income tax credit refunds, and $528 in child care subsidies. She then ends up paying $37 more in payroll taxes and $45 more in state income taxes. This happens because the more an employee makes, the more they pay into benefits and increases their tax payments, and decreases their eligibility for government programs .

While raising the minimum wage sounds like the perfect solution to raising everyone’s quality of life it actually creates a whirlwind of new problems. People could lose their jobs, their health insurance, and their tax credits which would in turn cause them to take home even less than they had with the current minimum wage. On top of affecting the individual it will make it nearly impossible for small businesses to thrive next to larger corporations and will put many smaller companies out of business. Instead of simply raising the wages the economy has to find a better solution, one that allows people to not ‘make more’ but to take home more.