While some of the focus has been taken off of HIV these days, the sad reality is there are still many people contracting and living with this virus in the U.S.: according to HIV.gov, about 1.2 million people in the U.S. have HIV. Fortunately, we have made great strides in controlling the virus with medication, and those living with HIV can now go on to live long and normal lives, which brings up the question of life insurance. Will life insurance cover people who are HIV positive?

HIV & Life Insurance

Because life insurance companies offer policies based on how risky it is to insure you, many life insurance companies will not insure you if you are living with HIV. With that being said, there are life insurance companies who will consider applicants who are HIV positive, and will offer traditional life insurance policies like term life, whole life, and even universal life insurance, with some limitations.

For example, insurers will generally not consider an applicant who was diagnosed less than a year before applying for coverage, and there are often age limits on applicants. In addition, you will have to go through the underwriting process, which will determine your rates; living with an illness like HIV will usually mean that your premiums will be higher than other people’s.

What To Expect During The Underwriting Process

When applying for life insurance, you have to disclose any health issues, including if you are HIV positive. Insurance companies will require that you provide information regarding:

- The date of your diagnosis

- Current CD4 count and viral load

- Medications you have been prescribed and the dosage of each

- Whether you are currently symptomatic or whether you have ever been symptomatic

In addition, during the underwriting process, life insurance companies will need to know what stage of HIV you have:

- Acute HIV, which is considered the earliest stage of the virus, extending from two to four weeks from the initial infection.

- Chronic HIV, meaning that your number of CD4 cells is decreasing, leading to damage to the immune system.

- AIDS, which is the most advanced stage of HIV.

Insurers will also ask your age, because most insurance companies that will consider an HIV positive applicant will require that the applicant be no older than 50 years old. They will want to know your overall health, including anything that could raise a red flag for them, as well as if you are following a treatment plan prescribed by a doctor, including managing the virus by taking prescribed medications and regularly having your CD4 levels checked.

Once you have disclosed all of the above information, you might have to wait a few weeks to a few months while the insurance company sifts through your medical records and the statements that they will request from your doctor.

Life Insurance Options For HIV Positive Applicants

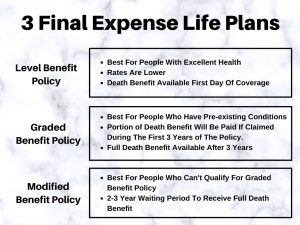

If you are unable to qualify for a traditional life insurance policy, you do have other options, most of which you can be approved for in a matter of days. These policies include:

Final Expense Insurance

This type of insurance is usually bought to cover funeral and burial expenses, as well as any medical debts. A final expense policy is ideal for you if you are living with a chronic health condition like HIV, because you are guaranteed approval.

Simplified Issue Life Insurance

This type of policy will not require a medical exam, although there will be some medical questions on the application. Premiums are usually higher for simplified issue policies than for traditional term life insurance because there is no medical exam, and those purchasing these policies might be riskier to insure.

Guaranteed Issue Life Insurance

This type of life insurance policy does not consider your health or health history during the underwriting process, which means anyone is eligible for it. The two downsides of guaranteed issue, though, are that your insurance company will cap the death benefit at $35,000, and your premiums will be higher than with traditional term life insurance, because you will be approved no matter how much of a risk you are to insure.

Term Life Insurance

If you are following a treatment plan, some life insurance companies will approve you for term life insurance.

Need Help?

Just because you are living with HIV does not mean you won’t be able to provide for your family when you are gone. Finding a life insurance plan that is affordable and will provide enough coverage for your family, though, means that you will have to do a lot of research and compare different insurance companies and their plans: some companies have strict underwriting guidelines, while others have looser guidelines, and they will all price plans differently. The best way to find the right life insurance policy for you and your specific needs is by working with an agent who specializes in life insurance. We have provided the top life insurance companies in the nation below; each offers hassle-free assistance and the most competitive rates. Always check multiple sites to make sure you have bargaining power and know the advantages of each company. Make sure a hard time isn’t made harder by a financial burden, check life insurance rates today.

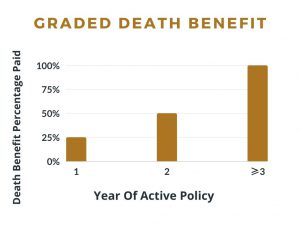

One of the major differences between graded death benefit policies and other types of policies is that the death benefits are paid out in percentages; after each year of having an active policy, your beneficiary will receive a higher portion of your death benefit:

One of the major differences between graded death benefit policies and other types of policies is that the death benefits are paid out in percentages; after each year of having an active policy, your beneficiary will receive a higher portion of your death benefit: