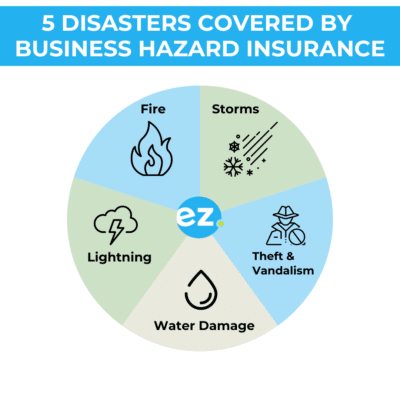

Disasters are unpredictable, and without the proper coverage, they can cause devastating financial losses for your company. That’s why business hazard insurance is critical for safeguarding against a wide range of potential hazards. From fires to vandalism and everything in between, hazard insurance ensures that your company is financially equipped to deal with damages and inconveniences caused. To understand why this coverage is important for your organization, let’s examine five frequent disasters covered by business hazard insurance.

Business Hazard Insurance for Fires

Fires are one of the most serious hazards that any business can face. Not only do they pose a threat to employees’ physical well-being, but they also have the potential to cause irreparable damage to facilities, documents, technology, and really anything else in their path. Fires are caused by a variety of circumstances including:

- Electrical Issues

- Cooking Accidents

- Wildfires

- Chemical Accidents

- Smoking

- And much more…

When it comes to dealing with the aftermath of a fire, business hazard insurance provides coverage for things like:

- Structural repairs and rebuilding.

- Replaces destroyed or damaged inventory.

- Provides coverage for lost wages during the interruption.

Take the state of California for example. In a region that is known for its frequent wildfires, business hazard insurance is a must. While damage from natural disasters, in the aftermath of these events, businesses with sufficient protection will be able to start rebuilding, while the owner’s with no coverage may not be able to recuperate their losses.

Business Hazard Insurance for Storms

Storms and severe weather come in a number of forms, all of which can be extremely damaging to businesses and their property. Such events include windstorms, tornadoes, hail, snowstorms, and

more. During these unfortunate events, businesses face risks like structural damage, broken windows, loose debris, and erosion. While we suggest that all organizations invest in business hazard

insurance, it’s particularly important if your company is in a storm-prone area. In these cases, be sure that the policy includes some sort of comprehensive storm coverage.

In the event of a damaging storm, business hazard insurance usually covers:

- Structural damage caused by winds and hail.

- Broken windows, signage and roofs in need of repair.

- Lost wages and other expenses caused by business interruption.

Business Hazard Insurance for Water Damage

Water damage can be catastrophic to businesses and while you should do everything possible to avoid these situations, sometimes they’re out of your control. While all policies vary, most business hazard policies cover claims involving water damage caused by leaks or burst pipes.

It’s important to note that business hazard insurance usually DOES NOT cover flood damage caused by rising water from hurricanes or extreme rain. For these circumstances, a separate flood insurance policy should be considered. Having a specialized flood insurance policy working in tandem with your business hazard insurance, ensures complete protection from all water-related incidents. With all that said, when it comes to water damage, be sure to read the fine print of your policy to understand what’s covered and what isn’t.

Business Hazard Insurance for Lightning Damage

Lightning strikes can cause significant harm to your business. Common damages caused by lightning include burn damage (if the lightning starts a fire), as well as damage to electrical systems and other equipment. The latter generally happens when a power surge takes place, which can affect any electrical infrastructure. Luckily, most business hazard insurance policies protect against lightning damage. In these scenarios, your policy should help to cover:

- Damaged equipment

- Structural damage

- Wages and expenses caused by the business interruption.

Lightning strikes are unpredictable and can happen anywhere, so it’s important to have a comprehensive protection plan in place. In the aftermath of a damaging lightning strike, business hazard insurance will help your organization to recover quickly without facing large out-of-pocket expenses.

Business Hazard Insurance for Vandalism and Theft

While most of the hazards we’ve discussed involve the weather, remember that not all risks come from natural disasters. Unfortunately, two of the most common business damages are theft and vandalism. When we talk about theft and vandalism, it usually refers to goods being stolen, property being damaged, or defaced in some way. In most cases, business hazard insurance will protect against such incidents by covering:

- The repair costs of vandalized property.

- The replacement costs of stolen inventory or goods.

- The costs of security upgrades to help avoid future issues.

Protect Your Company From The Unexpected

Whether it’s a fire, tornado, break-in, burst pipe or power surge, business hazard insurance will protect your organization from financial ruin. Without adequate protection these distatars can

result in huge out-of-pocket expenses, or the need to shut down for an extended period – both of which could destroy your business. When considering your needs in relation to business hazards, it’s important to understand what you’re already covered for. Then, based on a variety of risk factors such as the nature of your business and your geographic location, consider adding on additional protection.

Don’t wait for disaster to strike. Instead, be prepared and get a free quote from EZ.Insure. Our easy-to-use comparison platform allows you to view competing plans side-by-side, ensuring that you find something that matches your budget and needs. We also have a library of articles, all aimed at helping business owners save money and stay protected. So what are you waiting for? To get your quote just enter your ZIP code at the top of this page, or call us at 855-694-0047.