Keeping your business’s doors open depends on a number of factors and maintaining your business’s property and equipment is a huge part of the equation. If company assets are damaged in a fire or natural disaster, without sufficient insurance coverage it can be difficult for businesses to recover. This is where hazard insurance comes in.

Table of Contents

- What is Hazard Insurance?

- What Does Hazard Insurance Cover?

- Does My Business Need Hazard Insurance?

- The Cost of Hazard Insurance

- Hazard Insurance for a SBA Loan

- Is Hazard Insurance Tax Deductible?

- FAQs

- Get Hazard Insurance Today

What Is Hazard Insurance?

Hazard insurance is a type of business coverage that protects commercial properties and assets against physical damage stemming from storms, fires, vandalism and theft. If a business suffers losses due to one of these events, hazard insurance helps pay for replacing or repairing buildings, offices, equipment, and inventory.

It’s important to note that hazard insurance is typically a portion of a broader commercial property insurance policy. While commercial property insurance provides a more comprehensive coverage, oftentimes providing coverage for operational disruptions, hazard insurance focuses solely on protecting a business’s physical structure and assets.

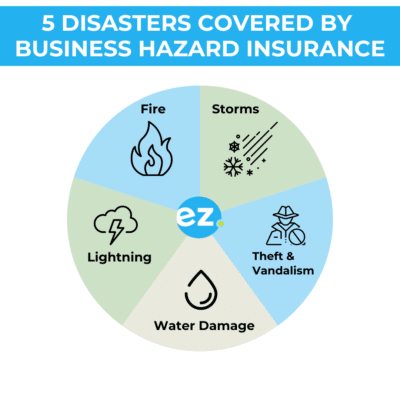

What Does Hazard Insurance Cover?

Hazard insurance covers both the building that your business owns or rents, as well as the equipment that it uses. Depending on your policy, hazard insurance will generally cover the cost to repair or replace the following items:

- Personal property

- Tools and equipment

- Inventory

- Furniture

- Computers

- Accounts receivable

- Documents

- Outdoor landscaping

It will cover damages to the above due to the following types of events:

- Fire and smoke damage

- Theft and vandalism

- Some weather-related events such as hail, lightning, snow, sleet, or ice

- Explosions

- Aircraft or vehicles

- Sprinkler leakage

- Building collapse

- Water damage (in certain specific cases)

Damages caused by floods, earthquakes, acts of terrorism, nuclear attacks, or damage resulting from war are typically not covered by hazard insurance policies. You will need a separate insurance policy to protect your business from these occurrences.

Does My Business Need Hazard Insurance?

Hazard insurance is generally not required by law. With that being said it is crucial to help cover the costs of damages if a disastrous event occurs. Without a comprehensive hazard insurance policy, owners are forced to pay for repairs out of pocket, which isn’t always possible for small business owners. Additionally, many lenders and financial institutions require businesses to have some form of hazard insurance before issuing mortgages or loans.

The Cost of Hazard Insurance

The price of hazard insurance will vary widely depending on a number of factors, including:

- The age of your building/property – If the workspace that you own or rent is older, you’ll typically pay higher premiums because repairs to older properties tend to be more expensive.

- The value of your building/property – The higher the total value of your assets, the higher the premium for this coverage will be.

- Whether you choose a cash value or replacement cost policy – With a policy that pays out based on the actual cash value of your property, your payout will be determined by how much your property was originally purchased for before it was damaged. But if you have a policy that pays out based on replacement value, you will be covered for how much it would cost to buy a brand new version of the item that was damaged. Because of the effects of depreciation, cash value insurance is typically more affordable than replacement value insurance.

- Coverage limits – As is the case with the vast majority of insurance policies, your monthly premiums will go up as you add more coverage.

- Lender requirements – A lender may require that you have a certain amount of property insurance coverage before they will approve your application for a loan. The more insurance your lender requires, the larger your premium will be.

Hazard Insurance for a SBA Loan

The Small Business Administration (SBA) helps small businesses get the credit they need by putting the government’s name on loans made by commercial lenders. The lender provides the loan, and if the borrower doesn’t pay back the loan, the SBA will cover up to 85% of the loss.

To get a small business loan from the SBA, you need to show that you have hazard insurance. Having this type of policy shows that you own real assets that can be taken if you can’t pay back the loan. For example, if a construction company wants to borrow money to buy a piece of equipment but can’t pay back the loan, the lender can take ownership of the equipment.

Types of Hazard Insurance SBA Might Require

In order to be eligible for a loan from the SBA, you will have to show that your business has adequate insurance coverage. This could mean having general liability coverage as well as commercial property insurance/hazard insurance. Keep in mind that depending on the kind of loan you want to get, the Small Business Administration might require you to have other types of insurance coverage, such as workers’ compensation.

Specifically, the Small Business Administration requires the following when it comes to hazard insurance:

- The minimum required coverage amount is 80% of loan principal.

- Your business’s name must appear on the insurance policy.

- Your DBA name must be included in the policy if you use one.

- You must show proof of the required insurance within 12 months of receiving your loan. If your business does not already have it when you apply for your loan.

Is Hazard Insurance Tax Deductible?

The Internal Revenue Service considers business insurance premiums to be an ordinary and necessary business expense. So, yes it can be tax deductible. But there are other factors to think about when determining if your hazard insurance is tax deductible.

If you have a home-based business, you may be able to deduct some of your operating costs from your taxable income. Insurance premiums can fall into this category, along with utilities and home office essentials. For instance, you can deduct half of your annual hazard insurance premiums if your home is used for business purposes in excess of 50% of the time.

If your company suffers losses in an area where a federal disaster declaration has been issued, you may be eligible for deductions. If you have hazard insurance and your insurer only pays a portion of your claim, for instance. You can deduct the amount of your claim up to $500 per incident.

FAQs

Do I need hazard insurance if I run a home-based business?

Yes, even if you run a home-based business, you’ll likely need a business hazard insurance policy. Homeowners insurance usually does not cover business-related property, or if it does, the policy limits on these assets are very low. To ensure that all of your business property is protected, it’s suggested to purchase a hazard or commercial property insurance policy, even if you already have a homeowners policy.

How much does hazard insurance cost for small businesses?

The cost of a hazard insurance policy varies based on factors such as location, equipment value, industry, property value, building age and more. With all that being said, on average small businesses pay about $67 per month or $800 per for a comprehensive policy.

Does hazard insurance cover natural disasters like floods and earthquakes?

Most hazard insurance policies do not cover floods and earthquakes. If your business is located in an area where these types of disasters are prevalent, you’ll need to purchase a separate flood insurance or earthquake insurance policy.

Get Hazard Insurance Today with EZ.Insure!

At EZ.Insure, our insurance agents work with the leading insurance companies across the country to ensure that you have access to the best coverage options for your business and its employees. In fact, we can save you hundreds of dollars annually by tailoring our search to find you exactly what you need, at the best price possible. To get a free quote, simply enter your ZIP code in the box below or give us a call at (855)-694-0047.