The chance of a man developing testicular cancer is around 1 in 250, meaning that between 8 and 10 thousand men will develop it each year. Fortunately, the recovery rate for testicular cancer is very high: around 95% of all men with testicular cancer will beat it if they catch it early. But what exactly are the signs of testicular cancer that will help you detect it early? Have you or your loved one been checked for it lately? Find out just what to look for, how this cancer is diagnosed, and how it is treated.

What Is Testicular Cancer?

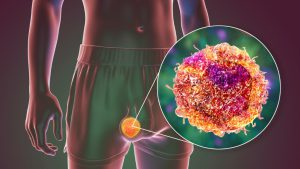

Testicular cancer occurs when cancer cells develop in the tissue of a testicle. It is very rare that the cancer cells will develop in both testicles, but it can happen. More than 90% of testicular cancer cases start in the germ cells, which are cells in the testicles that develop into sperm. There are two primary types of these testicular germ cell cancers:

- Seminoma– This type accounts for around 30 to 40% of testicular cancers, and grows slowly in young germ cells.

- Non-seminoma– This type occurs in more mature germ cells, and grows into more aggressive tumors.

Who Is At Risk?

While testicular cancer can occur at any age, it is most common in men between the ages of 20 and 35, with an average diagnosis age of 33 years old. It tends to be at its most malignant amongst 22 to 40-year-old men. Diagnosis is most common in Caucasian men, and less common in African American, Latino, and Asian American men. In fact, Caucasian men are four to five times more likely to develop testicular cancer than African-American men, and three times more likely than Asian American men.

In addition, men who are at most at risk are those who have:

- Undescended testicles, which means one or both testicles did not move down into the scrotum before birth

- Family history, such as a brother or father who had testicular cancer

- Infertility

Symptoms

It’s important to recognize the signs of testicular cancer, since the earlier you catch it, the more likely you are to beat it. Symptoms to look out for include:

- Tenderness in the scrotum

- A lump or swelling in either testicle

- A shrinking testicle

- Pain or discomfort in the scrotum or testicle

- Fluid in the scrotum

- A dull ache in the groin or lower abdomen area

Diagnosis

If you or your loved one experience any of the above-mentioned symptoms, it is important to see a doctor right away. Your doctor will order an ultrasound to see if there are any abnormalities in the testicle; if there are any abnormalities or evidence of cancer, you will need to have surgery to remove the testicle, so it can be examined to see whether cancer is present. Testicular cancer can only be diagnosed after the testicle is removed and examined; unfortunately, biopsies cannot be performed on testicles.

Aside from ultrasounds, other tests to help diagnose testicular cancer can include:

- A tumor marker test– A blood sample is taken and is used to measure the number of certain substances linked to specific types of cancers. The tumor markers that are often elevated in cases of testicular cancer are alpha-fetoprotein, human chorionic gonadotropin, and lactate dehydrogenase.

- CT scans and X-rays- CT scans and X-rays can be performed to determine if there is cancer present anywhere else in the body, usually the abdomen and pelvis.

Treatment

On the rare occasion that testicular cancer is found, there are three different kinds of treatment available, including:

- Surgical treatment- The testicle is removed, as well as some lymph nodes. Surgery can also be performed in certain situations to remove tumors from the lungs or liver if they do not disappear after receiving chemotherapy.

- Radiation therapy- High-dose radiation will be used to kill cancer cells. This type of treatment is more commonly used for cases of seminomas.

- Chemotherapy– Drugs are administered to kill cancer cells in cases of both seminomas and non-seminomas.

Prevention

Unfortunately, there is no way to prevent testicular cancer, but early detection can help immensely. You should perform a self-examination once a month to see if there are any lumps or issues in your testicles and scrotum. It’s best to perform the exam in a warm shower because the warm water relaxes the skin of the scrotum making it easier to feel for anything unusual.

When performing the exam, you should feel around for any lumps that are pea-sized or larger, as well as check to see if there has been any change in the size of your testicles. If you find a lump, the next step is to immediately contact your healthcare provider.

It is also important to get a physical exam once a year so that your doctor can check you, as well. To get the preventive care you need, you’ll need a good health insurance plan that will allow you to see your doctor regularly, and get any treatments you might need. If you’re looking for an insurance plan, EZ can help: we offer a wide range of health insurance plans from top-rated insurance companies in every state. And because we work with so many companies and can offer all of the plans available in your area, we can find you a plan that saves you a lot of money – even hundreds of dollars – even if you don’t qualify for a subsidy. There is no obligation, or hassle, just free quotes on all available plans in your area. To get free instant quotes, simply enter your zip code in the bar above, or to speak to a local agent, call 888-350-1890.