What Is A Point-of-Service Plan?

A point-of-service (POS) plan is a type of managed-care health insurance plan that gives different benefits based on whether the policyholder uses in-network or out-of-network healthcare providers. You can choose whether or not to stay in the network each time you need health care services. With this type of insurance, all of your costs rely on the “point” of service, which is the doctor or hospital where you get care. A Point of Service (POS) plan has some of the same benefits as HMO and PPO plans, but the amount of benefits depends on whether you get your care from a provider in the health insurance company’s network or from a provider outside of the network.

How Point-Of-Service Plans Work

A POS plan begins like an HMO plan, you have to choose a primary care provider (PCP). Your PCP is in charge of coordinating your health as well as giving you referrals to see specialists, which will not be covered without a referral. A POS is also similar to a PPO in that it still covers some services that you get out-of-network, but you will have to pay more than you would for in-network care. The POS plan will pay more for a service outside of the network if the primary care doctor sends the policyholder there instead of the policyholder going outside the network without a recommendation.

The premiums for a POS plan are between those of an HMO, which are cheaper, and a PPO, which are higher. Co-payments are usually only $10 to $25 per visit when you go to a doctor who is in your plan’s network. POS plans also don’t have fees for services that are covered by the plan. This is a big difference from PPOs. POS plans cover the whole country, which is good for patients who move a lot. Out-of-network costs tend to be high for POS plans, which is a bad thing. When a deductible is high, it means that patients who use services outside of their plan’s network will have to pay the full cost of their care until they hit the deductible. If a patient never uses out-of-network services on a POS plan, they might be better off with an HMO because the premiums are cheaper.

Point-of-Service Cost

On the Affordable Care Act (ACA) marketplace, a POS plan costs an average of $505 per month for a 30-year-old, $568 per month for a 40-year-old, and $794 per month for a 50-year-old. On the ACA marketplace, the price of a POS health insurance plan relies on a number of things. Some of the things that affect how much you pay for health insurance are:

- Age

- Where you live

- Tobacco use

- Plan tier

- Dependents

- Plan design

- Insurance Company

Additionally, the costs of your plan rely on where you get coverage. For instance, the cost of individual health insurance plans bought directly from an insurance company is different from the cost of plans bought through the ACA marketplace. If your workplace offers a POS plan, you can expect to pay much less because the premiums for employer-sponsored plans are subsidized.

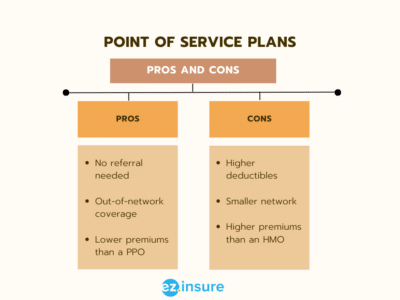

Advantages and Disadvantages of Point-of-Service Plans

POS plans often cost less than other types of health insurance, but they only cover a smaller number of doctors. You can see doctors who are not in their network, which is a good thing, but it will cost you more. Each type of insurance plan has pros and cons. Knowing the pros and cons of POS insurance plans can help you decide if it’s the right choice for you and your family.

Advantages

- Affordability – Since POS plans are a mix of PPOs and HMOs, their premiums aren’t always the cheapest. However they are still affordable. In fact they actually cost less than PPOs. Affordability comes into play with in-network copays. POS plans don’t make you pay your deductible before getting coverage. Instead, you pay a copay every time you see an in-network provider. This is beneficial if you’re working within a budget.

- Out-of-Pocket Limits – With a POS plan, you have to meet your deductible before any out-of-network care will be covered, but the deductible is lower than a PPO plan, and there are limits. The out-of-pocket limit is set so that you will never spend more than a certain amount for healthcare in a year. Once you meet that limit, your insurance will pay for all of your doctor visits and treatment, both in and out of the network.

- Flexibility – With a POS insurance plan, you have to pay your deductible before you can get coverage from a provider who is not in your network. However, the yearly cost is less than PPO deductibles, and you can’t pay more than a certain amount during the year. Once the out-of-pocket limit is met, your insurance will pay for all of your doctor visits and treatments.

Disadvantages

- Costs – Even though POS plans are cheaper than PPO plans, which is a benefit, they can still be as expensive as HMO rates. If you don’t fully understand your plan, you may be paying more than you would for another type of health insurance. For example, if your PCP is not in the network, you’ll pay more to see them than if they were in the network of your HMO.

- Confusing – Since POS insurance plans are less popular than HMOs and PPOs, they can be hard to understand, making it hard to know how much you’ll pay when you see a doctor or specialist.

- Paperwork – These plans also require a lot of paperwork if you want to see a doctor who isn’t in their network and pay their fees up front, which may not be possible with your budget. After seeing the doctor, you’ll need to file a claim for repayment and wait for a decision, which can be scary.

POS Vs. HMO

Most of the time, HMO plans cost less than other plans. The premiums and out-of-pocket costs for HMO health insurance are much cheaper than those for POS plans. Even though HMO health insurance is less expensive than POS health insurance, it has fewer benefits. Unless it’s an emergency, HMO plans don’t cover care from doctors who aren’t in their network. If you go to a source who is not in your network, you have to pay for the whole service. HMO plans require you to work with a primary care provider and get a referral to see an expert, just like POS plans. Because care from outside the network isn’t covered, HMO members have access to a much smaller network of general care providers, specialists, and hospitals.

POS Vs. PPO

One of the most popular types of health insurance is PPO. You don’t need a referral to see an expert if you have PPO health insurance, and you can see a doctor in or out of your network. PPO health insurance is often a good choice if you don’t mind taking care of yourself. In the ACA marketplace, the average monthly rates for PPO and POS plans are about the same.

POS Vs. EPO

POS Vs. EPO

An Exclusive Provider Organization (EPO) plan is similar to an HMO plan. An EPO plan pays for medical services when you go to a source in the plan’s network. If you go to a doctor who is not in your network, you will have to pay the whole price (except in an emergency). However, if you have EPO insurance, you usually don’t need a primary care provider or a referral to see an expert. If an expert is part of the EPO’s network, your insurance company should pay for the service. POS plans tend to be more expensive than EPO plans in terms of cost. In general, health insurance plans that cover care outside of the plan’s network cost more than plans that only cover care within the network.

Working With EZ

There are a lot of different kinds of health insurance plans to choose from. So, it all comes down to what you want, how much money you have, and how healthy you are. The best way to find the right plan for you is to look into what each plan has to offer. So, you can get the most service for as little money as possible. Remember that health insurance is important, even if you’re in good health most of the time. You never know what could happen, so it’s best to be safe. To get started, just type your zip code into the box below. Or call 877-670-3557 to talk to one of our certified agents.