When thinking of tariffs and the impact they have on everyday people, you may expect an increase in the cost of food or materials for businesses or home projects— but what about your auto insurance?

While you’re probably aware of the tariffs that were recently imposed on foreign vehicles, you might have not realized the trickle down effect they’ll have on your insurance policy. From delays when ordering specialized parts to rising repair costs, the impact of tariffs is real and should not be ignored.

Whether you have a sedan that you drive a few days a week, or a fleet of commercial vehicles that your business relies on, understanding the effect that tariffs have on your vehicle insurance is key to keeping costs down and remaining financially protected on the road.

How Tariffs Trickle Down to Auto Insurance Premiums

While insurance companies don’t automatically add an extra “tariff fee” to auto insurance policies, that doesn’t mean they aren’t affected. Since tariffs increase the cost of imported goods such as parts and vehicles, in turn, replacement and repair costs also go up. Because of this, insurers are forced to factor the uptick in expenses into their risk models, which can ultimately impact the monthly premiums you pay. Let’s break it down further.

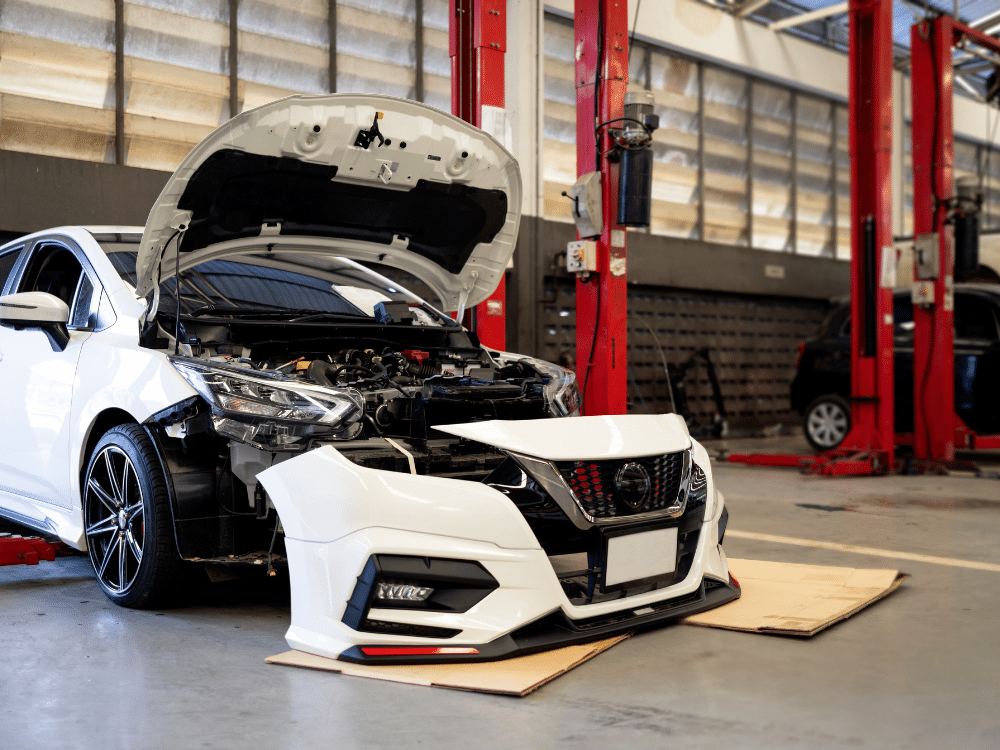

Vehicle Repairs Are More Expensive

Time to face facts. Many of the parts we use in the United States to repair vehicles are imported from other countries. Even with cars that are primarily manufactured in the U.S., mechanics often rely on imports for specialized components. So what does that mean for you? Essentially, this price hike and other factors increase the overall price you pay for repairs in a couple different ways:

- Higher Prices for Parts: Tariffs set on countries that produce high volumes of parts and vehicles, like China, Canada, Mexico and Germany, ultimately raise the cost of common repairs. Some specifically affected parts include bumpers, windshields, engine components, safety sensors, and rear-view cameras.

- Longer Delays and Higher Labor Costs: Since businesses are forced to deal with supply chain issues or switch suppliers altogether, it’s taking longer to receive part orders. This issue makes the repair process also take longer, and cost more. In turn, this can cause claim payouts by insurers to increase, and premiums to rise, especially for collision and comprehensive coverage.

Bottom Line: As the cost of common repairs start to increase, insurance companies are forced to pass those costs on to consumers, generally through higher premiums.

Higher Vehicle Prices = Higher Insurance Premiums

Since the price of many automotive parts are becoming more expensive, so are the costs of purchasing vehicles. Whether the vehicle you purchase is domestic or imported, prices are going up, since even U.S. manufactured cars contain parts subject to tariffs, but where will you notice the impact?

- New Car and Insurance Prices: If you are thinking about purchasing a new car that cost $20,000 last month, but now costs $25,000, the cost to insure will also increase due to the increase in car value.

- Impact on Replacement Coverage: If your current auto insurance policy offers “new car replacement” benefits, the payout amount may go up, since many cars are now valued at a higher price.

Tariffs Increase Commercial Auto Insurance Costs Too

If you own a business that uses commercial vehicles, you may be wondering the impact that tariffs will have on your bottom line. Whether it’s a single delivery van, or 100 freight trucks, you’ll likely eventually notice the following:

- Fleet Vehicle Replacement Costs: Due to the same reasons previously discussed (increase in parts costs, increase in labor costs, supply chain issues, etc.) if you need to purchase a new van, truck or work vehicle, the sticker price will likely be increased.

- Specialized Equipment Costs: Vehicle modifications or speciality equipment that’s imported from other countries are becoming more expensive. This means the value of your vehicle will rise, but so will your insurance needs.

- Repair Delays: The rise and costs and supply chain changes can make repairs take longer, which could have an effect on your operation as a whole.

What You Can Do to Keep Costs Down

While the tariffs might be set in stone for now, there are various ways to keep your insurance and repair costs down in the meantime. Here are some proactive steps to take to keep your premiums low, while still maintaining comprehensive coverage:

For Individual Drivers:

- Purchase Cars with Low Repair Costs: If you’re shopping for a new or used vehicle, don’t just pay attention to the sticker price. It’s also important to research cars that have affordable and widely available parts, as well as low collision repair costs.

- Raise Your Deductible: If you’re looking to decrease the monthly premium you pay, increasing your deductible is a great way to do so. When increasing your deductible, just be sure to allocate some money to your savings account in case of a costly claim.

- Bundle Policies: Many insurers offer plan bundles, allowing you to combine your auto, home, renters, and even life insurance policy under the same provider. Doing so generally comes with a substantial discount.

- Use Insurance Comparison Tools: Instead of settling for the first insurance policy you set your eyes on, take the time to compare multiple plans to get the best rate. The easiest way to do this is by using an insurance broker who helps you find an affordable price, without compromising coverage.

For Business Owners:

- Review Fleet Coverage Annually: It’s crucial to re-evaluate your fleet’s insurance policy on a yearly basis at minimum. Doing so ensures that your vehicles are never underinsured, and that your policy limits reflect the current market value of your vehicle and parts.

- Explore Policy Discounts: Some carriers offer discounts for fleets depending on how many vehicles you need insured, vehicle usage (how often your vehicles are driven), or other seasonal factors.

- Consider Aftermarket Parts: Using aftermarket parts for vehicle repairs is a cost-effective option. When considering the use of aftermarket parts, be sure to check your insurance policy to see if there are any restrictions against them.

- Invest in Risk Management Measures: Many insurers offer commercial drivers discounts if they install certain devices to reduce overall driving risks. These include anti-theft devices, dash cams as well as advanced driver training courses.

- Compare Plans with an Insurance Broker: The best way to ensure you’re not overpaying for your commercial auto insurance is by working with a broker who understands the pain points of your industry. EZ.Insure specializes in helping small businesses find the right commercial auto insurance coverage at the best rates. Whether you’re in delivery, construction, service trades or any other industry relying on commercial vehicles, we’re here to help you stay protected.

Closing Thoughts: Be Prepared, Not Surprised

Tariffs may initially seem like a challenge that merely affects importers, suppliers and manufacturers, but the truth is, they also impact vehicles, parts and ultimatly—insurance. Whether you have a vehicle for your daily commute, a car for weekend road trips, or an entire fleet of commercial vehicles, understanding the trickle down effect of current trade policies is crucial in helping you make cost-effective choices, and avoid future surprises.

If you’re currently in the market for commercial auto insurance, EZ.Insure is here to help you find the best coverage for the most affordable price. Our platform offers free insurance quotes, side-by-side plan comparisons, and 24/7 access to licensed insurance experts, to help you customize your coverage. Your business is your livelihood, so don’t settle when it comes to protecting its most valuable assets. Instead, visit EZ.Insure, and get the protection you and your company deserves.

To get a free commercial auto insurance quote, simply enter your ZIP code on the right side of the screen, or call us today at 855-694-0047.