When thinking of tariffs and the impact they have on everyday people, you may expect an increase in the cost of food or materials for businesses or home projects— but what about your auto insurance? While you’re probably aware of the tariffs that were recently imposed on foreign vehicles, you might have not realized…

How Tariffs Are Impacting Small Business Insurance

The current wave of US tariffs on imported goods are making headlines mostly for geopolitical reasons, but the impact they’ll have on small businesses is quite alarming. Increased expenses, interrupted supply chains, and new uncertain partnerships are affecting both the day-to-day operations as well as long term planning. However, one area that’s often overlooked, is…

How Much Does Insurance Cost for a Pressure Washing Business?

The costs of running a business are numerous - from equipment, supplies and marketing to payroll, taxes and insurance. But for many entrepreneurs, insurance is one of the biggest unknown expenses. How much will it cost to protect your business and comply with regulations? The numbers can vary widely depending on your location, services…

How to Choose an Insurance Agent FAQ

When in the market for an insurance policy, it’s tough to know where to start. With so many agents and brokers to pick from, it’s crucial to understand how to choose an insurance agent that’s right for you. It doesn't matter if you’re simply looking for a personal health insurance policy, or a comprehensive…

Workers’ Comp Exemption Explained

Workers’ Compensation is an essential type of commercial insurance coverage for most businesses, but not everyone is required to have it. To give you a better understanding about what workers’ comp exemptions are, we’ll be discussing: The professionals who may qualify for an exemption. Varying state laws in regards to exemptions. How to…

What is a Certificate of Insurance and Why Do You Need One?

A Certificate of Insurance (COI) is more than simply a piece of paper—it’s proof of your coverage and professionalism. Whether you're a contractor, small business owner, event organizer, or another profession, having a COI guarantees that you meet legal and client demands while simultaneously building trust with your partners. Now let’s take it…

Do You Need Commercial Insurance For Uber?

Driving for Uber or another ride-sharing is an awesome way to earn extra money, but it also comes with some risks. On top of that, most standard auto insurance won’t fully cover you while on the job. That’s why it’s crucial to understand the types of coverage you need, the average cost, and how…

General Liability vs. Professional Liability: What to Know

Consider this scenario: a client sues your company for inaccurate advice, or someone slips and falls at your workplace. Suddenly, you're facing thousands of dollars in unanticipated legal fees—all as a result of a simple error or accident. If you own a small business, protecting yourself from these dangers is critical. But do you…

Restaurant Insurance 101: Coverages Every Owner Should Have

Today you’ll discover the essential coverages that restaurant insurance offers: Protection against expensive accidents. Peace of mind for you and your employees. And a competitive edge in the restaurant industry. Let’s get started. Restaurant insurance is a specific type of business insurance designed to meet specific requirements associated with the…

The Importance of Product Liability Insurance for Your Business

Product liability insurance is an essential form of protection for businesses who produce, distribute or sell goods and products. Regardless of how careful you are when producing or selling items, accidents happen. If an accident does happen to occur and it involves injury, damage or defects relating to your product, you could be held liable. …

Do You Need Home-Based Business Insurance? 5 Questions to Ask

There are many benefits that come with running your business from home. This includes convenience, flexibility as well as comfort. With all this being said, many home-based business owners don’t consider the risks associated with running an organization from their house. This poses the question — “Do I actually need insurance for my home-based business?”…

5 Essential Reasons Why Your Business Needs Insurance

Imagine putting in years of hard work, money, and passion to establish your business, only to have it all come crashing down due to an unforeseen event. It could be as minor as a lawsuit from a dissatisfied customer or as severe as a fire that destroys your office. These unexpected incidents can not only…

5 Disasters Covered by Business Hazard Insurance

Disasters are unpredictable, and without the proper coverage, they can cause devastating financial losses for your company. That's why business hazard insurance is critical for safeguarding against a wide range of potential hazards. From fires to vandalism and everything in between, hazard insurance ensures that your company is financially equipped to deal with damages and…

Why New Businesses Need Startup Insurance

Here is a list of all the necessary insurance types for your new business with explanations and requirements.

How to Lower Your Workers’ Compensation Premiums

As a small business owner, you care about your employees' success, as well as their wellbeing and their safety in the workplace. With that said, even the most conscientious employers have to face the fact that mishaps can and will occur even in the safest of workplaces. Accidents are inevitable in any workplace. So, it's…

Commercial Insurance for Startups

You’re not starting any ordinary small business. You’re building a startup. Your goal is to grow and, in order to do this, you not only need a solid business plan, but also protection for everything that you’re building. Startups are inherently risky, so it is extremely important that you get the right commercial insurance coverage. …

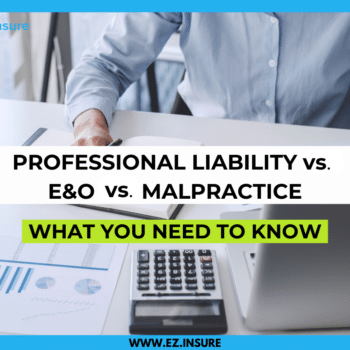

Professional Liability vs E&O vs Malpractice

It’s time to settle something once and for all. Are all types of liability insurance created equally? The quickest answer is, of course, no. General liability covers the physical damage that we often think of when we think of commercial insurance: property damage or a personal injury that happens on your premises. But then we…

Does Your Business Need Intellectual Property Insurance?

If your business is run out of an office, a shop, or any other physical location, then you already have property insurance to protect yourself against the unexpected, right? Fire or theft are very real threats and you would never want to leave your business exposed. But what about the business assets you can’t see:…